The Coolest Business Analytics Companies Of The 2023 Big Data 100

Part 1 of CRN’s Big Data 100 takes a look at the vendors solution providers should know in the data analytics and business intelligence space.

Analytical Approach

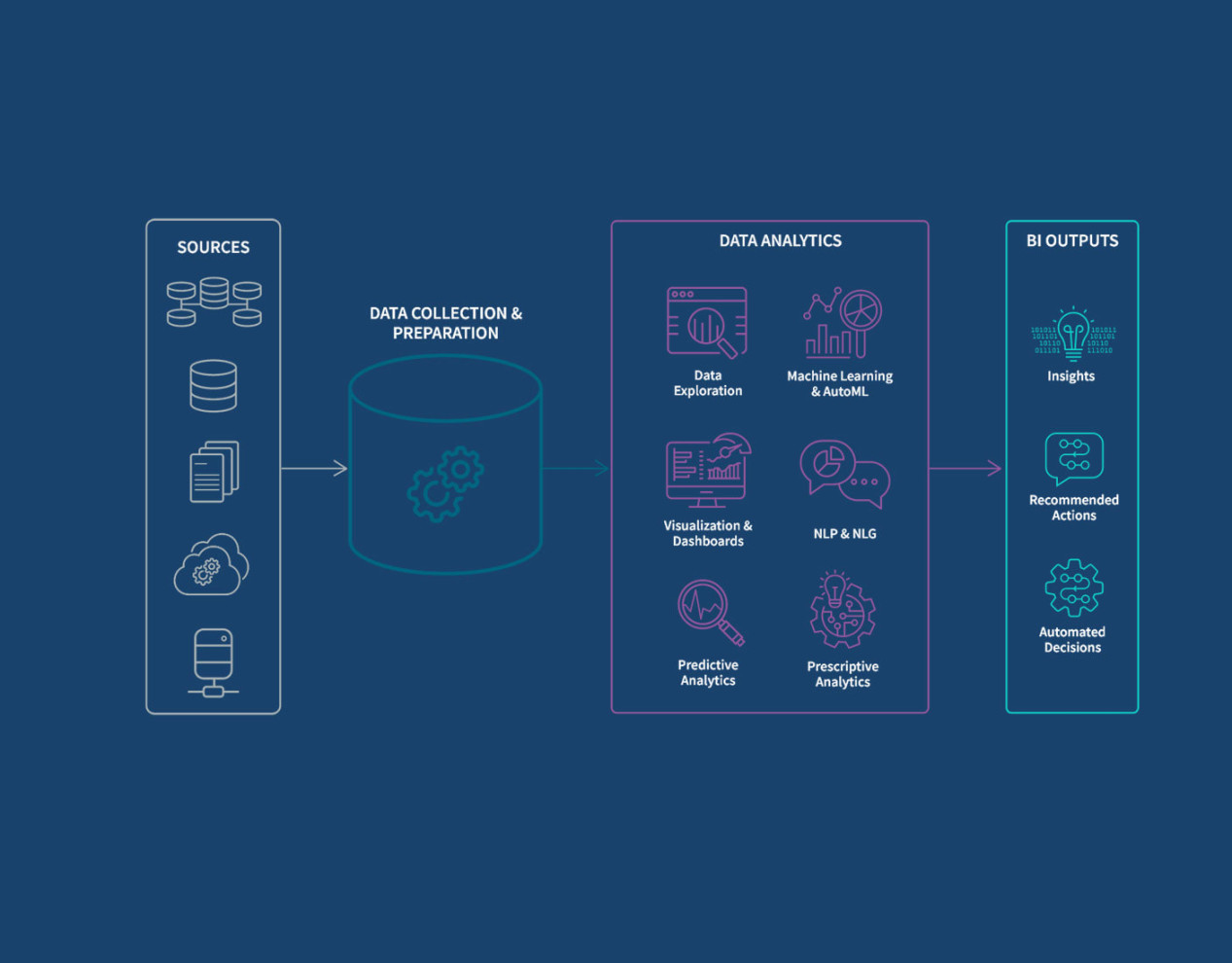

It’s no surprise that in diagrams and visual representations of big data IT systems, data analytics and visualization software are usually at the top of the big data “technology stack.” They are the software tools that business analysts and information workers use to gain understanding and insight from the exponentially growing volumes of data businesses are generating today and to share that knowledge throughout an organization.

Worldwide sales of business intelligence software are expected to reach $25.73 billion this year, up 8.6 percent from $23.70 billion in 2022, and reach $34.16 billion by 2028, according to market research firm Statista.

“Companies’ needs for data insights, customer analyses, and all kinds of business processes have strongly increased due to digitization and data that is collected online. This development drives the demand for enterprise software, especially business intelligence software,” said a Statista report.

As part of the CRN 2023 Big Data 100, we’ve put together the following list of business analytics software companies—from well-established vendors to those in startup mode—that solution providers should be familiar with.

These vendors offer everything from self-service reporting and data visualization tools for nontechnical managers and business users to high-performance business analysis software needed by data analysts to tackle the most complex business intelligence tasks.

This week CRN is running the Big Data 100 list in a series of slide shows, organized by technology category, spotlighting vendors of business analytics software, database systems, data warehouse and data lake systems, data management and integration software, data observability tools, and big data systems and cloud platforms.

Some vendors market big data products that span multiple technology categories. They appear in the slideshow for the technology segment in which they are most prominent.

Ahana

Co-Founder and CEO: Steven Mih

Ahana develops Ahana Cloud for Presto, a software-as-a-service data analytics service based on Presto, the open-source SQL query engine used to query data in a range of data sources including database and data lakehouse systems.

Venture-backed Ahana, founded in 2020 and based in San Mateo, Calif., was acquired by IBM earlier this month. With the acquisition IBM joined the Presto Foundation, part of the Linux Foundation.

Alteryx

CEO: Mark Anderson

Alteryx offers its flagship Alteryx Analytics Automation Platform, a unified data analytics and data science automation system, and the Alteryx Analytics Cloud Platform, along with a number of additional business intelligence, machine learning and developer tools.

In February the company unveiled new self-service and enterprise-grade capabilities to the enterprise edition.

Alteryx executives say the Irvine, Calif.-based company has recorded significant momentum in the channel after undertaking a major expansion of its partner program in 2022 as part of a shift to a more partner-centric sales strategy.

AtScale

CEO: Chris Lynch

AtScale develops semantic layer technology for business intelligence that the company says insulates data consumers from the complexity of working with raw data.

The AtScale software creates a business-oriented data model and virtualizes queries for cloud data platforms such as Amazon Redshift, Snowflake, Google Big Query and Databricks without the need for ETL (extract, transform, load) tools or data movement.

This year AtScale, headquartered in Boston, has expanded its connections to the Databricks platform, including the Databricks Lakehouse for Manufacturing, and achieved the Snowflake Ready Technology Valuation for business intelligence solutions. In April the company introduced code-first data modeling capabilities for its semantic layer platform.

CelerData

CEO: James Li

Startup CelerData markets a high-performance unified analytics platform based on the StarRocks massively parallel processing SQL database for real-time analytics. CelerData’s founders developed StarRocks in 2020 and earlier this year contributed it to the Linux Foundation.

In March CelerData, headquartered in Menlo Park, Calif., took aim at the fast-growing data lakehouse space with a new release of its software with a cloud-native architecture, real-time streaming analytics, and support for open data table formats Hudi, Iceberg and Delta Lake.

Domo

CEO: Josh James

Domo develops its namesake “data experience” platform, a cloud-based, mobile data analytics and visualization system that provides decision makers with real-time business data from a wide range of operational applications and data sources.

In March the American Fork, Utah-based company debuted Domo Cloud Amplifier, which the company says helps users unlock data across multiple cloud platforms using a single virtual layer.

On March 6, Domo said that John Mellor, who served as Domo’s chief strategy officer for three years and then CEO for more than a year, was stepping down and that Josh James, the company’s founder and original CEO, was again assuming the CEO post.

Hitachi Vantara

CEO: Gajen Kandiah

Hitachi Vantara, a wholly-owned subsidiary of Hitachi Ltd., offers a portfolio of data analytics, data storage and data operations products, the latter including data integration, catalog and optimization tools and content intelligence software. The product suite includes the company’s Pentaho data integration and analytics platform.

Incorta

CEO: Osama Elkady

Incorta develops the Open Data Delivery Platform, a system for acquiring, processing and analyzing raw, operational data from business applications in real time. The platform, with Incorta’s Direct Data Mapping technology, connects to more than 240 data sources.

In March, Incorta, based in San Mateo, Calif., joined Google Cloud’s Ready BigQuery and AlloyDB in initiatives, validating its technology for those Google Cloud systems and making it easier for businesses and organizations to move business application and ERP (enterprise resource planning) data into the cloud.

Kyligence

CEO: Luke Han

Kyligence Enterprise, the company’s flagship multi-dimensional analytics platform, is designed to analyze massive datasets with its data modeling, query and processing capabilities. The platform is based on the open-source Apache Kylin distributed OLAP engine that was developed by Kyligence’s founders.

Earlier this month San Jose, Calif.-based Kyligence announced the general availability of Kyligence Zen, an intelligent metrics platform for developing and centralizing all types of data metrics into a unified catalog system.

Kyvos Insights

CEO: Praveen Kankariya

Kyvos Insights offers a data analytics acceleration platform, based on the company’s Smart OLAP technology, that the company says improves the performance of business intelligence tools like Tableau, Google Cloud Looker and Microsoft Power BI.

MicroStrategy

President and CEO: Phong Lee

MicroStrategy is one of the long-time players in the data analytics arena and bills itself as the largest independent, publicly traded business intelligence company. Headquartered in Tysons Corner, Va., MicroStrategy offers its enterprise analytics and embedded analytics platforms as part of the company’s “intelligence everywhere” vision.

In February the company reported that revenue in 2022 was $499.3 million, down more than 2 percent from $510.8 million in 2021.

In addition to its analytics software business, MicroStrategy also acquires and holds Bitcoin and as of the end of 2022 owned 132,500 Bitcoin.

Promethium

CEO: Kaycee Lai

Startup Promethium says that its collaborative data virtualization platform accelerates data analytics projects by eliminating data management and analytics complexity.

Promethium touts its software as a key element for data fabric initiatives that connect an organization’s data for analytics, machine learning and other tasks without the need for traditional ETL tools and approaches.

Pyramid Analytics

CEO: Omri Kohl

Pyramid Analytics describes the company’s Pyramid Decision Intelligence Platform as a fully integrated, no-code, AI-driven system that combines data preparation, data science, and self-service and augmented business analytics capabilities.

The company has been accelerating the expansion of its channel alliances over the last year including establishing partnerships with technology companies, ISVs, VARs, consulting firms and systems integrators. In November the company hired former IBM and Oracle executive Bill Clayton as vice president of global partner sales.

Earlier this month Amsterdam-based Pyramid Analytics said it is expanding into Mexico and Latin America via a series of partner agreements with top regional technology consultants including Analytics Mate, AS Analytics, BACIT, EMC Software C.A. and Hopewell Systems C.A.

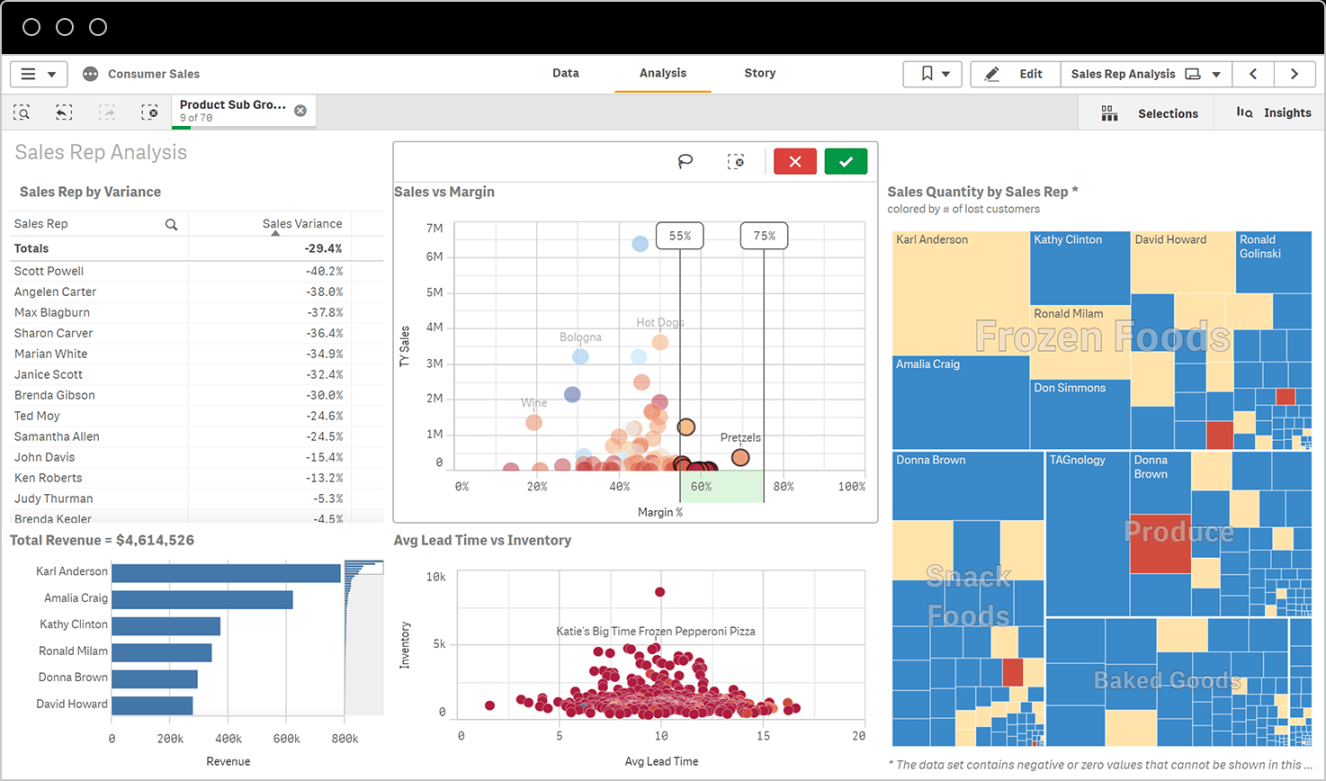

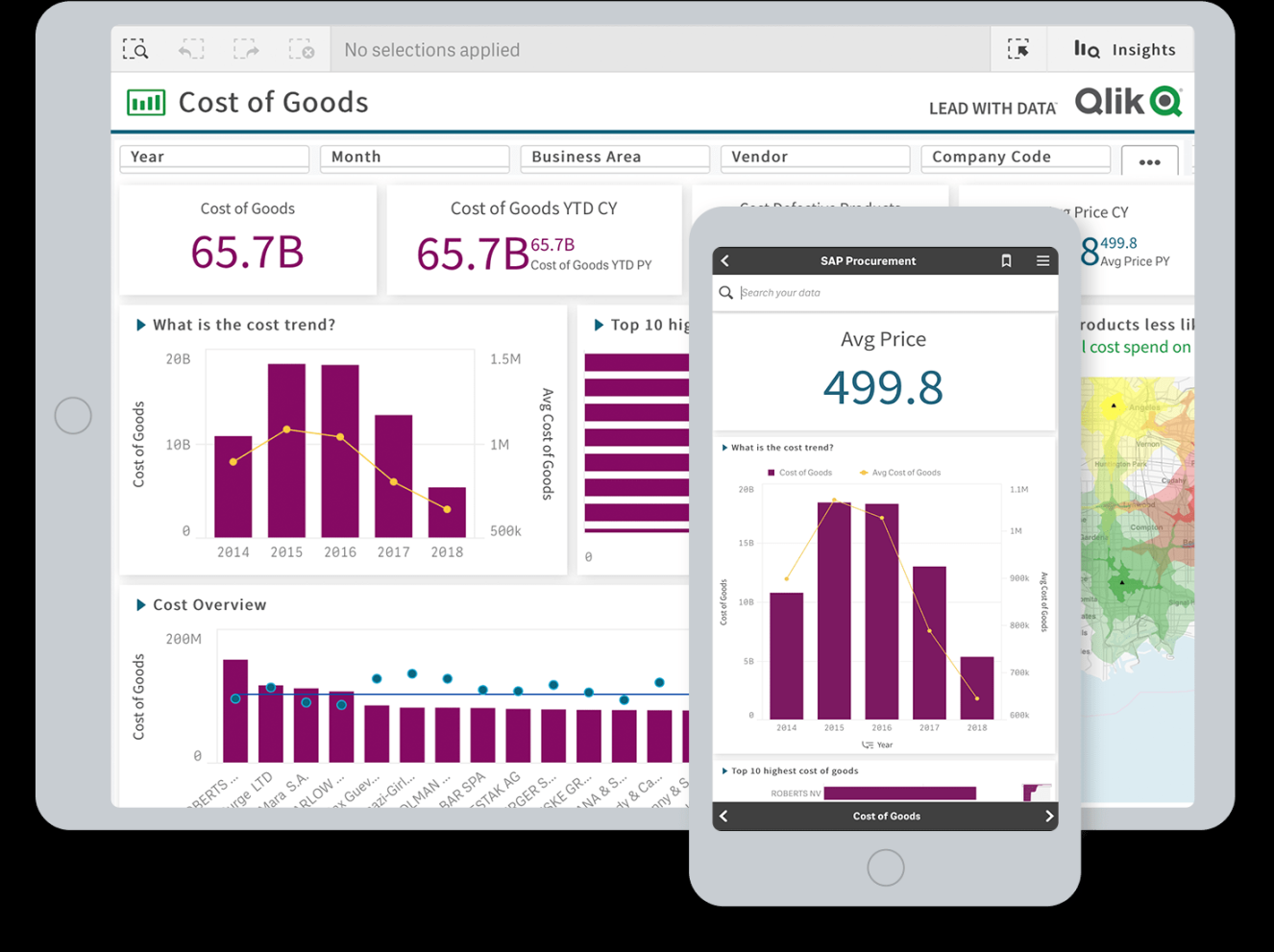

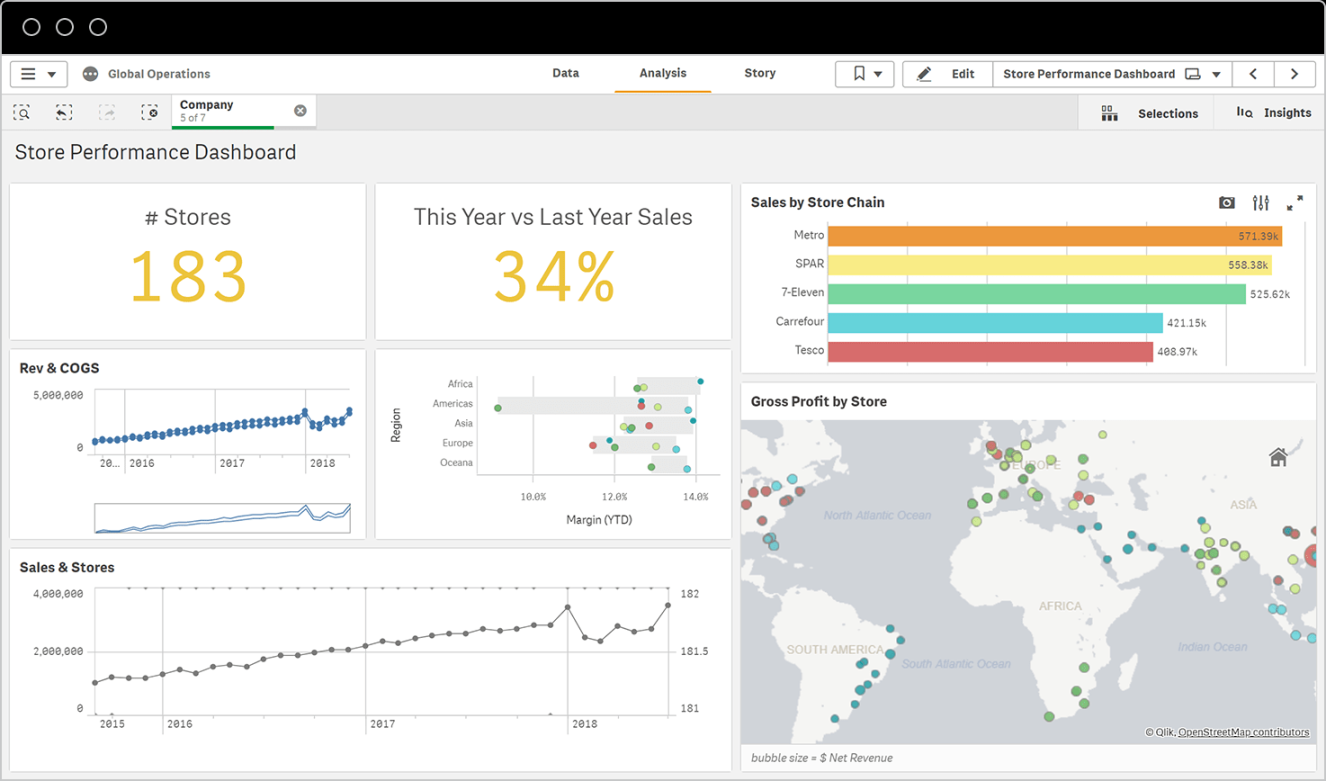

Qlik

CEO: Mike Capone

Qlik is one of the leading business analytics providers with its flagship Qlik Sense data analytics, discovery and visualization software.

The company has expanded beyond its core analytics offerings in recent years with a number of savvy acquisitions including data integration tech developer Attunity in 2019 and automated machine learning software developer Big Squid in 2021. Qlik is now in the process of acquiring Talend, a leading provider of data management and integration tools.

In March Qlik launched its Connector Factory initiative to broaden the range of SaaS applications, legacy software and data sources that can link to its data analytics and integration products.

Rockset

CEO: Venkat Venkataramani

Rockset offers a cloud-based search and analytics database service for developing real-time analytical applications that require low-latency, high-concurrency analytical queries and data aggregations. The service is built on the RocksDB real-time indexing database.

In January Rockset said the San Mateo, Calif.- based company recorded exponential growth in 2022, including annual recurring revenue that grew 3.6x during the year and a customer based that more than doubled in size.

Salesforce/Tableau

CEO: Marc Benioff

Tableau Software was one of the industry’s most popular data analytics and visualization tools when cloud application giant Salesforce acquired the company in August 2019 for $15.7 billion.

Since then, Salesforce has been integrating Tableau with its other products, including its Einstein Discovery for predictive analytics and its Slack messaging application.

Earlier this year Tableau was updated with new data mapping capabilities and a new “Data Stories” capability for Tableau Server that uses natural language to automatically create a fully customizable story in narrative form to help business users understand analytical results.

SAS

CEO: Jim Goodnight

SAS is one of the largest and most established companies in the big data space and offers one of the industry’s broadest business analytics product portfolios led by its flagship SAS Viya data analytics, AI and data management platform.

In addition to Viya SAS develops a number of business analytics applications for specific tasks, such as marketing fraud detection and risk management, and for specific industries including banking, insurance, life sciences and retail.

In June 2022, SAS expanded its expertise and technology offerings in financial risk management with its acquisition of Hawaii-based Kamakura and its portfolio of applications for the financial services industry.

Privately held SAS, headquartered in Cary, N.C., is looking to go public over the next year or so and is taking financial and operational steps in preparation for an initial public offering.

Sisense

CEO: Amir Orad

The Sisense business analytics portfolio includes the Sisense Fusion Analytics platform, Sisense Fusion Embed for building analytical capabilities into applications and workflows, and Sisense Infusion Applications that provide data to users of everyday business applications including Microsoft Office 365 and Teams, Google Sheets and Slack.

Starburst

CEO: Justin Borgman

Starburst develops a data analytics platform, Starburst Enterprise, that can analyze huge volumes of data distributed across multiple locations – an alternative to the traditional approach of collecting and consolidating data in a central data warehouse. The company also offers Starburst Galaxy, a fully managed data lake analytics platform for handling petabyte-scale datasets.

The company’s software is built on the open-source Trino distributed SQL query engine. In June 2022 Starburst acquired Varada, an Israeli developer of data lakes acceleration technology. In April the company announced new integration with dbt Cloud, allowing data teams to more easily build data pipelines spanning multiple data sources on one central plane.

In early 2022 Starburst raised $250 million in a Series D funding round that at the time put the startup’s valuation at $3.35 billion.

ThoughtSpot

CEO: Sudheesh Nair

ThoughtSpot is one of the leading vendors in the data analytics space with its search-driven ThoughtSpot Analytics and ThoughtSpot Everywhere software. Earlier this year the company debuted ThoughtSpot Sage, which provides natural language analytics through GPT-3 integration.

Through 2020 and 2021 the company made a major pivot to cloud computing with its Modern Analytics Cloud offering.

In March ThoughtSpot, headquartered in Mountain View, Calif., announced an expanded strategic partnership with Google Cloud under which ThoughtSpot runs natively on the Google Cloud Platform and is integrated with a number of Google Cloud services.

Tibco/Cloud Software Group

CEO: Tom Krause

Tibco offers a portfolio of data management, integration and analytics products assembled through a series of acquisitions and organized as “Connect,” “Unify” and “Predict” products. Tibco Spotfire, for example, is the company’s flagship data analysis software while Tibco Statistica has been renamed Tibco Data Science.

In 2022 Tibco, owned by Vista Equity Partners, was merged with cloud and virtualization tech vendor Citrix Systems (acquired by Vista and Elliott Management affiliate Evergreen Coast Capital) in a $16.5 billion deal to create the Cloud Software Group.

Exciting New Partnership: Optimum and Qlik Join Forces to Transform Data Analytics for Clients

With Seamless Data Integration and Cutting-Edge Visualization, This Partnership Will Drive Business Growth and Empower Data-Driven Decisions for Businesses of All Sizes

HOUSTON, TX / ACCESSWIRE / August 8, 2024 / Optimum Consultancy Services, a leader in IT consulting that specializes in data, business intelligence (BI), and artificial intelligence (AI) solutions, is thrilled to announce a new strategic partnership with Qlik®, a renowned leader in data integration and data analytics solutions.

This partnership is set to transform the way businesses leverage data for strategic decision-making. Through this collaboration, Optimum will integrate Qlik’s cutting-edge BI tools and data integration solutions into its service offerings. This includes the powerful Qlik Sense® platform, known for its associative analytics engine and sophisticated AI, and Qlik’s comprehensive data integration and quality solution, Qlik Talend® Cloud.

Qlik Sense® will enable Optimum’s clients to unlock powerful insights from their data, enhancing decision-making processes with interactive dashboards, fully interactive analytics apps, and beautiful reports that are accessible on any device. Additionally, the partnership will leverage Qlik’s data integration and quality to ensure that data is not only seamlessly integrated but also maintained with the highest quality and integrity. This means clients can trust the data at their fingertips, making it easier to achieve compliance with data regulations and standards.

‘We are thrilled to partner with Qlik to enhance our clients’ data integration and analytics capabilities,’ says Nooshin Yazhari, President and CEO of Optimum. ‘This partnership not only enhances our BI and AI offerings but also strengthens our data integration and quality services, ensuring our clients have access to the best tools in the industry. We are confident that our partnership with Qlik will unlock new opportunities for our clients and drive growth for their businesses.’

Benefits for Clients:

Enhanced Data Capabilities: Clients will benefit from a seamless blend of Optimum’s expertise and Qlik’s technological prowess, leading to enhanced capabilities in data processing, analytics, and decision-making.

Streamlined Operations: With improved data integration and quality, businesses can streamline their operations, reduce costs, and increase efficiency.

Competitive Advantage: By leveraging real-time data insights and forecasts, businesses can stay ahead of market trends and make informed strategic decisions that provide a competitive edge.

Scalability: The solutions provided are scalable, ensuring that as a business grows, its data solutions can grow with it without performance loss.

This strategic partnership is effective immediately, and Optimum is ready to assist businesses in implementing these powerful solutions to harness the full potential of their data.

For more information about Optimum’s partnership with Qlik, please visit our Qlik offerings page or contact us at 713.505.0300 | info@optimumcs.com.

About Optimum

Optimum Consultancy Services, based in Houston, Texas, is a leading IT consulting firm focused on delivering top-tier data and business intelligence solutions. Specializing in integrating and optimizing complex data environments, Optimum leverages cutting-edge technologies, such as Qlik, to empower clients with actionable insights and tailored analytics strategies. As a trusted advisor in the IT sector, Optimum partners with industry-leading software providers to enhance its service offerings, ensuring clients receive comprehensive, state-of-the-art support that drives significant business outcomes. Known for its commitment to excellence and innovation, Optimum continually strives to transform the data capabilities of its clients nationwide.

Learn more at www.optimumcs.com.

About Qlik

Qlik converts complex data landscapes into actionable insights, driving strategic business outcomes. Serving over 40,000 global customers, our portfolio provides advanced, enterprise-grade AI/ML and data management. We excel in data integration and governance, offering comprehensive solutions that work with diverse data sources. Intuitive analytics from Qlik uncover hidden patterns, empowering teams to address complex challenges and seize new opportunities. Our AI/ML solutions, both practical and scalable, lead to better decisions, faster. As strategic partners, our platform-agnostic technology and expertise make our customers more competitive.

© 2024 QlikTech International AB. All rights reserved. All company and/or product names may be trade names, trademarks and/or registered trademarks of the respective owners with which they are associated.

Contact Information

Nooshin Yazhari President and CEO nyazhari@optimumcs.com 713.505.0300

Gabby de Janasz Marketing Specialist gdejanasz@optimumcs.com 713.505.0300

Keith Parker Senior Director, Global Corporate and Executive Communications keith.parker@qlik.com 512.367.2884

SOURCE: Optimum Consultancy Services

View the original press release on newswire.com.

Financial Data Analysts: Making Sense of Big Data in FinTech

Share

Share

Share

Financial technology, or FinTech, data is the new gold. Companies are increasingly relying on vast amounts of data to make informed decisions, drive innovation, and maintain a competitive edge. This influx of data has given rise to a critical role within the industry: the Financial Data Analyst. These professionals are tasked with deciphering complex data sets to provide actionable insights that can shape the future of financial services.

Big Data has become a buzzword across various industries, but its impact on FinTech is particularly profound. With the proliferation of digital transactions, online banking, and mobile payments, the financial industry generates an enormous amount of data daily. This data includes everything from transaction records and customer behavior patterns to market trends and social media interactions. For FinTech companies, leveraging this data is not just a competitive advantage; it is a necessity.

However, the sheer volume, variety, and velocity of data generated in the financial sector can be overwhelming. This is where Financial Data Analysts come into play. Their expertise in data analysis helps FinTech companies navigate the complexities of Big Data, transforming it into valuable insights that drive business growth.

The Role of a Financial Data Analyst

Financial Data Analysts are the backbone of data-driven decision-making in FinTech. They possess a unique blend of financial acumen and data science skills, enabling them to interpret complex data sets and provide actionable recommendations. Their role extends beyond mere number-crunching; they are responsible for identifying patterns, trends, and anomalies that can inform strategic decisions.

Data Collection and Preparation

The first step in the data analysis process is data collection. Financial Data Analysts gather data from various sources, including transaction records, customer databases, market reports, and external data feeds. This data is often unstructured and requires significant cleaning and preprocessing before it can be analyzed. Data preparation involves removing duplicates, filling in missing values, and converting data into a structured format that can be easily analyzed.

Data Analysis and Interpretation

Once the data is prepared, Financial Data Analysts use a range of analytical tools and techniques to extract insights. This may involve statistical analysis, data mining, machine learning, and predictive modeling. The goal is to identify patterns, correlations, and trends that can inform business decisions. For example, a Financial Data Analyst might analyze customer transaction data to identify spending patterns, which can then be used to develop targeted marketing campaigns or personalized financial products.

Risk Management and Fraud Detection

One of the critical functions of Financial Data Analysts in FinTech is risk management. By analyzing historical data, they can identify potential risks and develop strategies to mitigate them. This is particularly important in areas such as credit risk assessment, where analysts use data to evaluate the creditworthiness of borrowers. Additionally, Financial Data Analysts play a crucial role in fraud detection. By analyzing transaction data in real-time, they can identify suspicious activities and flag potential fraud before it causes significant damage.

Compliance and Regulatory Reporting

The financial industry is heavily regulated, and FinTech companies must comply with various laws and regulations. Financial Data Analysts help ensure compliance by analyzing data to monitor adherence to regulatory requirements. They also assist in preparing regulatory reports, which are essential for maintaining transparency and avoiding legal penalties. In this way, Financial Data Analysts help FinTech companies navigate the complex regulatory landscape.

The Tools and Technologies Empowering Financial Data Analysts

The role of Financial Data Analysts is heavily reliant on technology. A wide array of tools and technologies are available to assist them in their tasks, from data visualization software to advanced machine learning algorithms. Below, we explore some of the key technologies that empower Financial Data Analysts in the FinTech industry.

Data Visualization Tools

Data visualization is a crucial aspect of data analysis. Financial Data Analysts use visualization tools to present complex data in a more understandable and actionable format. Tools like Tableau, Power BI, and Qlik allow analysts to create interactive dashboards, charts, and graphs that can be easily interpreted by non-technical stakeholders. These visualizations enable decision-makers to grasp insights quickly, facilitating more informed business decisions.

Machine Learning and AI

Machine learning and artificial intelligence (AI) are revolutionizing the way Financial Data Analysts work. These technologies enable analysts to automate complex tasks, such as predictive modeling and anomaly detection. For instance, machine learning algorithms can analyze vast amounts of data to predict future market trends or identify fraudulent activities in real-time. AI-powered tools also allow analysts to process unstructured data, such as text or social media posts, to gain additional insights.

Big Data Platforms

Handling Big Data requires specialized platforms that can store, process, and analyze large data sets efficiently. Financial Data Analysts often work with Big Data platforms like Apache Hadoop, Spark, and NoSQL databases. These platforms allow analysts to process massive data sets in parallel, reducing the time required for analysis. Additionally, cloud-based platforms like AWS, Google Cloud, and Microsoft Azure offer scalable solutions for storing and analyzing Big Data, making it more accessible for FinTech companies.

Programming Languages and Statistical Software

Financial Data Analysts rely on programming languages like Python, R, and SQL for data manipulation and analysis. Python and R are particularly popular due to their extensive libraries and frameworks for data science, such as Pandas, NumPy, and Scikit-learn. These languages allow analysts to perform complex statistical analyses, build predictive models, and automate repetitive tasks. SQL, on the other hand, is essential for querying and managing data in relational databases, making it a vital tool for data retrieval and preparation.

Challenges Faced by Financial Data Analysts

While the role of Financial Data Analysts is crucial, it is not without its challenges. The dynamic nature of the FinTech industry, coupled with the complexities of Big Data, presents several obstacles that analysts must overcome.

Data Quality and Integrity

One of the most significant challenges Financial Data Analysts face is ensuring the quality and integrity of the data they analyze. Incomplete, inconsistent, or inaccurate data can lead to erroneous conclusions, which can have severe implications for business decisions. Analysts must implement robust data cleaning and validation processes to ensure the data they work with is reliable and accurate.

Data Privacy and Security

With the increasing focus on data privacy and security, Financial Data Analysts must navigate the challenges of handling sensitive information. Ensuring compliance with data protection regulations, such as GDPR and CCPA, is paramount. Analysts must implement stringent security measures to protect data from breaches and unauthorized access. Additionally, they must anonymize data where necessary to protect individual privacy while still extracting valuable insights.

Keeping Up with Technological Advancements

The rapid pace of technological advancements in FinTech means that Financial Data Analysts must continuously update their skills and knowledge. New tools, techniques, and frameworks are constantly emerging, and staying ahead of the curve is essential for maintaining a competitive edge. This requires ongoing education and training, as well as a willingness to adapt to new technologies and methodologies.

The Future of Financial Data Analysts in FinTech

As the FinTech industry continues to evolve, the role of Financial Data Analysts is set to become even more critical. The increasing reliance on data-driven decision-making will drive demand for skilled analysts who can interpret complex data and provide actionable insights. Moreover, advancements in AI and machine learning will further enhance the capabilities of Financial Data Analysts, allowing them to tackle even more sophisticated challenges.

Expanding Roles and Responsibilities

The scope of Financial Data Analysts’ roles is likely to expand in the future. As FinTech companies continue to innovate, analysts may find themselves involved in more strategic decision-making processes. They may also take on additional responsibilities, such as developing and implementing data-driven strategies or advising on the adoption of new technologies. This expanded role will require analysts to possess not only technical skills but also strong business acumen and strategic thinking.

The Rise of Real-Time Data Analysis

The future of financial data analysis lies in real-time data analysis. As FinTech companies strive to offer more personalized and immediate services, the ability to analyze data in real-time will become increasingly important. Financial Data Analysts will need to leverage advanced technologies, such as streaming analytics platforms, to process and analyze data as it is generated. This will enable FinTech companies to make instant decisions and offer more responsive services to their customers.

The Integration of ESG Data

Environmental, Social, and Governance (ESG) factors are becoming increasingly important in the financial industry. As investors and regulators place more emphasis on sustainability, Financial Data Analysts will need to integrate ESG data into their analyses. This will involve assessing the impact of ESG factors on financial performance and identifying investment opportunities that align with sustainability goals. The ability to analyze and interpret ESG data will become a valuable skill for Financial Data Analysts in the future.

Conclusion

Financial Data Analysts play a pivotal role in making sense of Big Data. Their expertise in data collection, analysis, and interpretation enables FinTech companies to make informed decisions, manage risks, and stay ahead of the competition. As the industry continues to evolve, the demand for skilled Financial Data Analysts will only increase, making this an exciting and dynamic field to be a part of. With the right tools, skills, and knowledge, Financial Data Analysts are well-positioned to drive the future of financial technology and help companies navigate the complexities of Big Data.

Financial Data Analysts: Making Sense of Big Data in FinTech

Share

Share

Share

Financial technology, or FinTech, data is the new gold. Companies are increasingly relying on vast amounts of data to make informed decisions, drive innovation, and maintain a competitive edge. This influx of data has given rise to a critical role within the industry: the Financial Data Analyst. These professionals are tasked with deciphering complex data sets to provide actionable insights that can shape the future of financial services.

Big Data has become a buzzword across various industries, but its impact on FinTech is particularly profound. With the proliferation of digital transactions, online banking, and mobile payments, the financial industry generates an enormous amount of data daily. This data includes everything from transaction records and customer behavior patterns to market trends and social media interactions. For FinTech companies, leveraging this data is not just a competitive advantage; it is a necessity.

However, the sheer volume, variety, and velocity of data generated in the financial sector can be overwhelming. This is where Financial Data Analysts come into play. Their expertise in data analysis helps FinTech companies navigate the complexities of Big Data, transforming it into valuable insights that drive business growth.

The Role of a Financial Data Analyst

Financial Data Analysts are the backbone of data-driven decision-making in FinTech. They possess a unique blend of financial acumen and data science skills, enabling them to interpret complex data sets and provide actionable recommendations. Their role extends beyond mere number-crunching; they are responsible for identifying patterns, trends, and anomalies that can inform strategic decisions.

Data Collection and Preparation

The first step in the data analysis process is data collection. Financial Data Analysts gather data from various sources, including transaction records, customer databases, market reports, and external data feeds. This data is often unstructured and requires significant cleaning and preprocessing before it can be analyzed. Data preparation involves removing duplicates, filling in missing values, and converting data into a structured format that can be easily analyzed.

Data Analysis and Interpretation

Once the data is prepared, Financial Data Analysts use a range of analytical tools and techniques to extract insights. This may involve statistical analysis, data mining, machine learning, and predictive modeling. The goal is to identify patterns, correlations, and trends that can inform business decisions. For example, a Financial Data Analyst might analyze customer transaction data to identify spending patterns, which can then be used to develop targeted marketing campaigns or personalized financial products.

Risk Management and Fraud Detection

One of the critical functions of Financial Data Analysts in FinTech is risk management. By analyzing historical data, they can identify potential risks and develop strategies to mitigate them. This is particularly important in areas such as credit risk assessment, where analysts use data to evaluate the creditworthiness of borrowers. Additionally, Financial Data Analysts play a crucial role in fraud detection. By analyzing transaction data in real-time, they can identify suspicious activities and flag potential fraud before it causes significant damage.

Compliance and Regulatory Reporting

The financial industry is heavily regulated, and FinTech companies must comply with various laws and regulations. Financial Data Analysts help ensure compliance by analyzing data to monitor adherence to regulatory requirements. They also assist in preparing regulatory reports, which are essential for maintaining transparency and avoiding legal penalties. In this way, Financial Data Analysts help FinTech companies navigate the complex regulatory landscape.

The Tools and Technologies Empowering Financial Data Analysts

The role of Financial Data Analysts is heavily reliant on technology. A wide array of tools and technologies are available to assist them in their tasks, from data visualization software to advanced machine learning algorithms. Below, we explore some of the key technologies that empower Financial Data Analysts in the FinTech industry.

Data Visualization Tools

Data visualization is a crucial aspect of data analysis. Financial Data Analysts use visualization tools to present complex data in a more understandable and actionable format. Tools like Tableau, Power BI, and Qlik allow analysts to create interactive dashboards, charts, and graphs that can be easily interpreted by non-technical stakeholders. These visualizations enable decision-makers to grasp insights quickly, facilitating more informed business decisions.

Machine Learning and AI

Machine learning and artificial intelligence (AI) are revolutionizing the way Financial Data Analysts work. These technologies enable analysts to automate complex tasks, such as predictive modeling and anomaly detection. For instance, machine learning algorithms can analyze vast amounts of data to predict future market trends or identify fraudulent activities in real-time. AI-powered tools also allow analysts to process unstructured data, such as text or social media posts, to gain additional insights.

Big Data Platforms

Handling Big Data requires specialized platforms that can store, process, and analyze large data sets efficiently. Financial Data Analysts often work with Big Data platforms like Apache Hadoop, Spark, and NoSQL databases. These platforms allow analysts to process massive data sets in parallel, reducing the time required for analysis. Additionally, cloud-based platforms like AWS, Google Cloud, and Microsoft Azure offer scalable solutions for storing and analyzing Big Data, making it more accessible for FinTech companies.

Programming Languages and Statistical Software

Financial Data Analysts rely on programming languages like Python, R, and SQL for data manipulation and analysis. Python and R are particularly popular due to their extensive libraries and frameworks for data science, such as Pandas, NumPy, and Scikit-learn. These languages allow analysts to perform complex statistical analyses, build predictive models, and automate repetitive tasks. SQL, on the other hand, is essential for querying and managing data in relational databases, making it a vital tool for data retrieval and preparation.

Challenges Faced by Financial Data Analysts

While the role of Financial Data Analysts is crucial, it is not without its challenges. The dynamic nature of the FinTech industry, coupled with the complexities of Big Data, presents several obstacles that analysts must overcome.

Data Quality and Integrity

One of the most significant challenges Financial Data Analysts face is ensuring the quality and integrity of the data they analyze. Incomplete, inconsistent, or inaccurate data can lead to erroneous conclusions, which can have severe implications for business decisions. Analysts must implement robust data cleaning and validation processes to ensure the data they work with is reliable and accurate.

Data Privacy and Security

With the increasing focus on data privacy and security, Financial Data Analysts must navigate the challenges of handling sensitive information. Ensuring compliance with data protection regulations, such as GDPR and CCPA, is paramount. Analysts must implement stringent security measures to protect data from breaches and unauthorized access. Additionally, they must anonymize data where necessary to protect individual privacy while still extracting valuable insights.

Keeping Up with Technological Advancements

The rapid pace of technological advancements in FinTech means that Financial Data Analysts must continuously update their skills and knowledge. New tools, techniques, and frameworks are constantly emerging, and staying ahead of the curve is essential for maintaining a competitive edge. This requires ongoing education and training, as well as a willingness to adapt to new technologies and methodologies.

The Future of Financial Data Analysts in FinTech

As the FinTech industry continues to evolve, the role of Financial Data Analysts is set to become even more critical. The increasing reliance on data-driven decision-making will drive demand for skilled analysts who can interpret complex data and provide actionable insights. Moreover, advancements in AI and machine learning will further enhance the capabilities of Financial Data Analysts, allowing them to tackle even more sophisticated challenges.

Expanding Roles and Responsibilities

The scope of Financial Data Analysts’ roles is likely to expand in the future. As FinTech companies continue to innovate, analysts may find themselves involved in more strategic decision-making processes. They may also take on additional responsibilities, such as developing and implementing data-driven strategies or advising on the adoption of new technologies. This expanded role will require analysts to possess not only technical skills but also strong business acumen and strategic thinking.

The Rise of Real-Time Data Analysis

The future of financial data analysis lies in real-time data analysis. As FinTech companies strive to offer more personalized and immediate services, the ability to analyze data in real-time will become increasingly important. Financial Data Analysts will need to leverage advanced technologies, such as streaming analytics platforms, to process and analyze data as it is generated. This will enable FinTech companies to make instant decisions and offer more responsive services to their customers.

The Integration of ESG Data

Environmental, Social, and Governance (ESG) factors are becoming increasingly important in the financial industry. As investors and regulators place more emphasis on sustainability, Financial Data Analysts will need to integrate ESG data into their analyses. This will involve assessing the impact of ESG factors on financial performance and identifying investment opportunities that align with sustainability goals. The ability to analyze and interpret ESG data will become a valuable skill for Financial Data Analysts in the future.

Conclusion

Financial Data Analysts play a pivotal role in making sense of Big Data. Their expertise in data collection, analysis, and interpretation enables FinTech companies to make informed decisions, manage risks, and stay ahead of the competition. As the industry continues to evolve, the demand for skilled Financial Data Analysts will only increase, making this an exciting and dynamic field to be a part of. With the right tools, skills, and knowledge, Financial Data Analysts are well-positioned to drive the future of financial technology and help companies navigate the complexities of Big Data.

Qlik Expands Cloud Deployment Options For Its Business Analysis Software

Big data company also debuts simpler licensing plan for partners and customers that cover on-premises and cloud deployments.

Qlik is shifting its business analytics software deeper into the cloud with this week’s move to allow businesses and organizations to deploy its flagship Qlik Sense Enterprise entirely on Qlik Cloud Services, the vendor’s Software-as-a-Service environment.

King Of Prussia, Pa.-based Qlik, which is holding its Qlik Qonnections customer and partner conference in Dallas this week, is also simplifying its licensing model for customers and partners that allows on-premises and multi-cloud deployments using a single license.

The “SaaS-first” availability for Qlik Sense Enterprise “is a game-changer for our partners. To be able to offer Qlik on a SaaS basis is something our partners have been asking for,” said Chris Moore, Qlik senior vice president of partners and alliances, in an interview with CRN.

[Related: The Coolest Business Analytics Companies Of The 2019 Big Data 100]

In addition to the option of deploying Qlik’s software on Qlik Cloud Services, the latest Qlik Sense Enterprise release can be deployed on Kubernetes in a private cloud or on a public cloud platform such as Amazon Web Services or Microsoft Azure. And all deployment options, including Qlik Sense Enterprise on Windows, now work as part of a single multi-site, multi-cloud framework that can be managed as one instance.

The new subscription license model incorporates both on-premises and cloud usage. “There was a lot of complexity around the licensing. Today there is just one license,” Moore said, noting that the company had heard from partners that its licensing plan was too complicated.

On the technology side, the latest release of Qlik Sense Enterprise offers a new capability called Associative Insights, a feature that identifies hidden insights within data and identifies data values that are unrelated to a user’s selections of questions. That, according to the company, helps users think outside the box and develop insights that might have been overlooked.

The new release also offers augmented intelligence capabilities including expanded natural language search support for Insight Advisor, a suite of Qlik Sense products for groups and teams, direct connections in the cloud to Salesforce and SAP applications, the ability to host QlikView applications in the cloud, a Qlik Sense mobile client for BlackBerry, and support for the Mobile Iron enterprise mobility management platform.

This week’s announcements follow Qlik’s moves to expand its technology portfolio through strategic acquisitions, including the acquisition of Podium Data in July 2018 and the acquisition of Attunity, which just closed last week.

Podium Data’s software became Qlik Data Catalyst, software used to build a catalog of all data throughout an organization that’s available for business analytics.

The acquisition of Attunity brings that company’s data integration and big data management technology into the Qlik portfolio, giving Qlik users the ability to combine data from multiple sources – even in real time – in preparation for data analysis.

Moore noted that while Qlik relies on resellers and other partners to reach about 80 percent of its customer base, Attunity focused more on a partner referral model with a particular emphasis on global and regional systems integrators.

Moore said there is about a 50 percent overlap between the two companies’ partner bases and he said partners see the Attunity acquisition as an opportunity to develop a data integration and data management practice.

Qlik’s acquisitions come as business analysis software vendors are trying to broaden their product lines with data integration, preparation and management tools and offer customers a more complete big data platform.

Qlik Introduces Qlik Answers to Transform Unstructured Data into Business Insights

PHILADELPHIA, July 30, 2024 — Qlik, a global leader in data integration, analytics, and artificial intelligence (AI), today announced the general availability of Qlik Answers, its newest self-service AI solution designed to help organizations harness the power of AI by removing the risk, embracing the complexity, and scaling the impact of AI. Qlik Answers transforms unstructured data into actionable results through generative AI, offering full explainability—a common obstacle in enterprise AI adoption.

Qlik Answers combines generative AI with Qlik’s trusted data analytics capabilities to deliver precise, contextually relevant results from extensive unstructured data sources. This solution enables customers to seamlessly integrate AI into their existing Qlik business intelligence workflows, ensuring efficient use of resources and avoiding technical debt.

“Qlik Answers is designed to help businesses use their unstructured data to make better decisions,” said Brendan Grady, Executive Vice President and General Manager of Qlik’s Analytics Business Unit. “This solution integrates our strengths in analytics and data with generative AI, providing users with precise answers to their questions. With Qlik Answers, we are offering a tool that supports the direct translation of unstructured data into tangible business outcomes.”

Key Benefits of Qlik Answers:

AI-Powered Responses: Delivers relevant answers from curated knowledge bases, enhancing the utility of unstructured data. Rapid Deployment: Offers a ready-to-use solution, reducing the time and complexity of deployment. Transparency: Ensures full explainability with answers linked to their source documents, fostering trust and consistency. Broad Connectivity: Integrates with existing systems and platforms, using Qlik’s enterprise connectors to access a variety of unstructured data sources. Enhanced Efficiency: Supports real-time business activities and decisions, enabling users to quickly access relevant information.

“We’re excited to see Qlik focus on unlocking business outcomes from unstructured data with Qlik Answers,” said Stefan Heinz, Senior BI & Analytics Manager at Bystronic Group. “The full explainability and integration with Qlik’s trusted analytics platform promise to drive responsible and effective use of AI at an enterprise level.”

Qlik Answers combines technologies to deliver reliable and efficient access to unstructured data. At its core, the solution uses Retrieval Augmented Generation (RAG), which merges retrieval-based and generative AI methods. This technique dynamically retrieves relevant documents from pre-indexed knowledge bases and generates precise, contextually relevant responses. By leveraging modern generative models, Qlik Answers can interpret and synthesize information from diverse sources, providing users with concise and actionable answers.

To ensure seamless integration with existing systems, Qlik Answers utilizes Qlik’s trusted enterprise connectors. These connectors allow the solution to access a wide range of unstructured data sources without requiring extensive data movement or reconfiguration. This approach not only simplifies deployment but also maintains data integrity and accessibility. Additionally, Qlik Answers is designed with full explainability and transparency in mind. All AI-generated answers are traceable back to their original sources, enabling users to verify and trust the information presented.

Qlik Answers is also self-service oriented, allowing business users to deploy and manage AI-driven knowledge assistants without needing extensive technical expertise or custom development. This ease of use ensures that organizations can quickly benefit from the solution, supporting real-time business activities and enhancing decision-making processes.

To learn more about Qlik Answers and how it can improve your business operations by unlocking the potential of unstructured data, visit Qlik Answers.

About Qlik

Qlik converts complex data landscapes into actionable insights, driving strategic business outcomes. Serving over 40,000 global customers, our portfolio provides advanced, enterprise-grade AI/ML and data management. We excel in data integration and governance, offering comprehensive solutions that work with diverse data sources. Intuitive analytics from Qlik uncover hidden patterns, empowering teams to address complex challenges and seize new opportunities. Our AI/ML tools, both practical and scalable, lead to better decisions, faster. As strategic partners, our platform-agnostic technology and expertise make our customers more competitive.

Source: Qlik

Exciting New Partnership: Optimum and Qlik Join Forces to Transform Data Analytics for Clients

With Seamless Data Integration and Cutting-Edge Visualization, This Partnership Will Drive Business Growth and Empower Data-Driven Decisions for Businesses of All Sizes

HOUSTON, TX / ACCESSWIRE / August 8, 2024 / Optimum Consultancy Services, a leader in IT consulting that specializes in data, business intelligence (BI), and artificial intelligence (AI) solutions, is thrilled to announce a new strategic partnership with Qlik®, a renowned leader in data integration and data analytics solutions.

This partnership is set to transform the way businesses leverage data for strategic decision-making. Through this collaboration, Optimum will integrate Qlik’s cutting-edge BI tools and data integration solutions into its service offerings. This includes the powerful Qlik Sense® platform, known for its associative analytics engine and sophisticated AI, and Qlik’s comprehensive data integration and quality solution, Qlik Talend® Cloud.

Qlik Sense® will enable Optimum’s clients to unlock powerful insights from their data, enhancing decision-making processes with interactive dashboards, fully interactive analytics apps, and beautiful reports that are accessible on any device. Additionally, the partnership will leverage Qlik’s data integration and quality to ensure that data is not only seamlessly integrated but also maintained with the highest quality and integrity. This means clients can trust the data at their fingertips, making it easier to achieve compliance with data regulations and standards.

‘We are thrilled to partner with Qlik to enhance our clients’ data integration and analytics capabilities,’ says Nooshin Yazhari, President and CEO of Optimum. ‘This partnership not only enhances our BI and AI offerings but also strengthens our data integration and quality services, ensuring our clients have access to the best tools in the industry. We are confident that our partnership with Qlik will unlock new opportunities for our clients and drive growth for their businesses.’

Benefits for Clients:

Enhanced Data Capabilities: Clients will benefit from a seamless blend of Optimum’s expertise and Qlik’s technological prowess, leading to enhanced capabilities in data processing, analytics, and decision-making.

Streamlined Operations: With improved data integration and quality, businesses can streamline their operations, reduce costs, and increase efficiency.

Competitive Advantage: By leveraging real-time data insights and forecasts, businesses can stay ahead of market trends and make informed strategic decisions that provide a competitive edge.

Scalability: The solutions provided are scalable, ensuring that as a business grows, its data solutions can grow with it without performance loss.

This strategic partnership is effective immediately, and Optimum is ready to assist businesses in implementing these powerful solutions to harness the full potential of their data.

For more information about Optimum’s partnership with Qlik, please visit our Qlik offerings page or contact us at 713.505.0300 | info@optimumcs.com.

About Optimum

Optimum Consultancy Services, based in Houston, Texas, is a leading IT consulting firm focused on delivering top-tier data and business intelligence solutions. Specializing in integrating and optimizing complex data environments, Optimum leverages cutting-edge technologies, such as Qlik, to empower clients with actionable insights and tailored analytics strategies. As a trusted advisor in the IT sector, Optimum partners with industry-leading software providers to enhance its service offerings, ensuring clients receive comprehensive, state-of-the-art support that drives significant business outcomes. Known for its commitment to excellence and innovation, Optimum continually strives to transform the data capabilities of its clients nationwide.

Learn more at www.optimumcs.com.

About Qlik

Qlik converts complex data landscapes into actionable insights, driving strategic business outcomes. Serving over 40,000 global customers, our portfolio provides advanced, enterprise-grade AI/ML and data management. We excel in data integration and governance, offering comprehensive solutions that work with diverse data sources. Intuitive analytics from Qlik uncover hidden patterns, empowering teams to address complex challenges and seize new opportunities. Our AI/ML solutions, both practical and scalable, lead to better decisions, faster. As strategic partners, our platform-agnostic technology and expertise make our customers more competitive.

© 2024 QlikTech International AB. All rights reserved. All company and/or product names may be trade names, trademarks and/or registered trademarks of the respective owners with which they are associated.

Contact Information

Nooshin Yazhari President and CEO nyazhari@optimumcs.com 713.505.0300

Gabby de Janasz Marketing Specialist gdejanasz@optimumcs.com 713.505.0300

Keith Parker Senior Director, Global Corporate and Executive Communications keith.parker@qlik.com 512.367.2884

SOURCE: Optimum Consultancy Services

View the original press release on newswire.com.

Qlik Introduces Qlik Answers to Transform Unstructured Data into Business Insights

PHILADELPHIA, July 30, 2024 — Qlik, a global leader in data integration, analytics, and artificial intelligence (AI), today announced the general availability of Qlik Answers, its newest self-service AI solution designed to help organizations harness the power of AI by removing the risk, embracing the complexity, and scaling the impact of AI. Qlik Answers transforms unstructured data into actionable results through generative AI, offering full explainability—a common obstacle in enterprise AI adoption.

Qlik Answers combines generative AI with Qlik’s trusted data analytics capabilities to deliver precise, contextually relevant results from extensive unstructured data sources. This solution enables customers to seamlessly integrate AI into their existing Qlik business intelligence workflows, ensuring efficient use of resources and avoiding technical debt.

“Qlik Answers is designed to help businesses use their unstructured data to make better decisions,” said Brendan Grady, Executive Vice President and General Manager of Qlik’s Analytics Business Unit. “This solution integrates our strengths in analytics and data with generative AI, providing users with precise answers to their questions. With Qlik Answers, we are offering a tool that supports the direct translation of unstructured data into tangible business outcomes.”

Key Benefits of Qlik Answers:

AI-Powered Responses: Delivers relevant answers from curated knowledge bases, enhancing the utility of unstructured data. Rapid Deployment: Offers a ready-to-use solution, reducing the time and complexity of deployment. Transparency: Ensures full explainability with answers linked to their source documents, fostering trust and consistency. Broad Connectivity: Integrates with existing systems and platforms, using Qlik’s enterprise connectors to access a variety of unstructured data sources. Enhanced Efficiency: Supports real-time business activities and decisions, enabling users to quickly access relevant information.

“We’re excited to see Qlik focus on unlocking business outcomes from unstructured data with Qlik Answers,” said Stefan Heinz, Senior BI & Analytics Manager at Bystronic Group. “The full explainability and integration with Qlik’s trusted analytics platform promise to drive responsible and effective use of AI at an enterprise level.”

Qlik Answers combines technologies to deliver reliable and efficient access to unstructured data. At its core, the solution uses Retrieval Augmented Generation (RAG), which merges retrieval-based and generative AI methods. This technique dynamically retrieves relevant documents from pre-indexed knowledge bases and generates precise, contextually relevant responses. By leveraging modern generative models, Qlik Answers can interpret and synthesize information from diverse sources, providing users with concise and actionable answers.

To ensure seamless integration with existing systems, Qlik Answers utilizes Qlik’s trusted enterprise connectors. These connectors allow the solution to access a wide range of unstructured data sources without requiring extensive data movement or reconfiguration. This approach not only simplifies deployment but also maintains data integrity and accessibility. Additionally, Qlik Answers is designed with full explainability and transparency in mind. All AI-generated answers are traceable back to their original sources, enabling users to verify and trust the information presented.

Qlik Answers is also self-service oriented, allowing business users to deploy and manage AI-driven knowledge assistants without needing extensive technical expertise or custom development. This ease of use ensures that organizations can quickly benefit from the solution, supporting real-time business activities and enhancing decision-making processes.

To learn more about Qlik Answers and how it can improve your business operations by unlocking the potential of unstructured data, visit Qlik Answers.

About Qlik

Qlik converts complex data landscapes into actionable insights, driving strategic business outcomes. Serving over 40,000 global customers, our portfolio provides advanced, enterprise-grade AI/ML and data management. We excel in data integration and governance, offering comprehensive solutions that work with diverse data sources. Intuitive analytics from Qlik uncover hidden patterns, empowering teams to address complex challenges and seize new opportunities. Our AI/ML tools, both practical and scalable, lead to better decisions, faster. As strategic partners, our platform-agnostic technology and expertise make our customers more competitive.

Source: Qlik