Microsoft Dynamics vs. Salesforce: Comparison 2024 Salesforce vs. Microsoft Dynamics 365 Overview

Salesforce’s Sales Hub and Microsoft Dynamics 365 Sales are similar products that offer most of the CRM features you expect to find in standalone CRM software. We compare these two as the primary CRM offerings from both providers, though other products exist for marketing, customer service and other work management functions.

Salesforce is a highly customizable CRM that teams can configure for almost any business need, while Microsoft Dynamics 365 serves as a centralized place for customer data for teams that already use it.

Salesforce vs. Microsoft Dynamics 365 Comparison

In our survey, CRM users cited workflow automation, contact activity tracking and task management as the most important CRM features. We used these insights to guide us as we tested Salesforce and Microsoft Dynamics 365. There are some notable differences between the platforms’ contact and sales pipeline management approaches, but they offer similar sales assistants powered by artificial intelligence (AI). Microsoft Dynamics is also commonly known as an enterprise resource planning (ERP) tool.

Source: MarketWatch Guides

Features Overview

Salesforce and Microsoft Dynamics 365 offer very similar feature lists for CRM. However, Salesforce offers more native features for marketing automation. Microsoft Dynamics does not include any email-related features in the Sales product, which puts it at a disadvantage compared to many other CRM platforms. Our Salesforce Review and Microsoft Dynamics 365 Review offer more in-depth analyses of these platforms’ top features.

Salesforce Sales CloudMicrosoft Dynamics 365 SalesMonthly Price Range$20-$500/user$65-$135/userContact Management✅✅Workflow Automation✅✅Lead Management✅✅Lead Scoring✅✅Pipeline Management✅✅Sales Forecasting✅✅Email Marketing Automation✅❌Analytics✅✅AI-Powered Tools✅(Einstein)✅(Copilot AI)Phone Support✅✅Live Chat✅✅ Contact Management

Microsoft Dynamics 356’s contact profiles are well-organized and easy to navigate, following a similar structure to many popular CRM systems. When we tested the platform, the profiles stood out as one of the more user-friendly features. We could add notes and easily edit contact information without searching through settings.

Aside from the contact profiles, Microsoft Dynamics’s approach to the overall contact list is unique. The different Excel-powered charts allowed us to get quick insights into the customer data on the platform. For instance, we could create a drill-down chart of contacts by their city in just a few clicks. While testing the platform, we imagined plenty of use cases for these quick insights and charts.

By comparison, Salesforce keeps its analytics separate from the customer profiles, which is the typical setup for customer data within most CRM platforms. The Salesforce customer profiles display contact information alongside upcoming tasks logged in the platform, related opportunities, deals and any quotes a customer has received. These capabilities make it simple for sales teams to refer to any information they need about a customer.

View of a sample customer profile in Salesforce.

Sales Pipeline Management

Microsoft Dynamics’s approach to the sales pipeline is unique compared to other CRM systems we’ve tested. By default, the platform organizes deals in various charts highlighting the sales funnel stages. Most platforms include a list of open deals or, most often, a Kanban-style view of the different deal stages, with movable deal cards sorted into various boards indicating their status.

This could be a major plus for teams that don’t love a Kanban board. However, for teams looking for streamlined and straightforward opportunity management, it could overcomplicate how team members view the sales process in the platform.

Salesforce’s default configuration for the sales pipeline is a more traditional deal tracking board with the option for a list view. We liked that dragging and dropping the deal cards with automatic deal value calculations at the top of each stage in the pipeline was easy.

Sample view of the Salesforce sales pipeline.

AI-Powered Features

Both Microsoft and Salesforce include AI assistants in their CRM products. Microsoft’s Copilot AI and Salesforce’s Einstein AI are helpful chatbots that users can interact with, similar to ChatGPT. These AI-powered tools also power forecasting, predictive scoring and other advanced features.

Microsoft just rolled out Copilot AI last year, and it is helpful for tasks like generating a summary of an open deal; however, it struggled to understand natural language requests. AI tools across the CRM space are very new, and we expect they will learn and improve over time to help streamline CRM strategies.

Pricing

Microsoft Dynamics 365 and Salesforce offer similar CRM pricing structures, so comparing their pricing is straightforward. Microsoft’s primary sales product has a lower starting price than Salesforce’s Sales Cloud, and Salesforce has a much more comprehensive price range, with the top Einstein 1 Sales plan costing $500 per user per month.

However, both platforms offer “starter kits” at lower prices with various features across the board. In Salesforce’s case, these are the Starter Suite and Pro Suite, which include top features from the Sales, Marketing and Service Clouds. The Microsoft Dynamics Business Central product is similar, with key features from Dynamics 365 Sales and Service, emphasizing core business functions and finance rather than marketing.

Salesforce Pricing

Our Salesforce Pricing Guide offers a more in-depth look into Salesforce’s pricing structure.

ProductPlanPriceSalesforce Sales CloudProfessional $80/user/month Enterprise $165/user/monthUnlimited$330/user/month Einstein 1 Sales$500/user/month Small Business (Combines Sales, Marketing and Service features) Starter Suite$25/user/monthPro Suite$100/user/month Microsoft Dynamics Pricing ProductPlanPriceMicrosoft Dynamics 365 SalesProfessional $65/user/month Enterprise $95/user/monthPremium$135/user/month Microsoft Dynamics 365 Business CentralEssentials$70/monthPremium$100/month Integrations

Salesforce is difficult to beat when it comes to native integrations, and it’s easy to search for any specific third-party apps you need to connect with the Appexchange marketplace.

The Microsoft Dynamics 365 CRM is excellent as part of a Microsoft ecosystem, but connecting it with outside tools is more complicated.Competitor software like Google tools won’t be available, and we were also surprised to see that Zapier integration was not an option for Dynamics 365 in the Microsoft AppSource marketplace. However, both platforms offer an API for developers.

PlatformSalesforce Sales Cloud Microsoft Dynamics 365 SalesGmail✅❌Google Calendar✅❌Mailchimp✅✅Facebook Ads✅✅Zoom✅✅Slack✅✅Sprout Social✅✅Shopify✅✅Stripe✅✅PandaDoc✅✅DocuSign✅✅Five9✅✅Trello✅❌Asana✅❌Zapier✅❌ Customer Support

Salesforce and Microsoft Dynamics 365 include customer support via live chat and phone. Unlike Microsoft, Salesforce’s advanced support options typically require an upgraded support package. For instance, all Salesforce licenses include the Basic Support package, which consists of the phone and chat options you’d expect. However, for personalized onboarding support or a dedicated Customer Success Manager, teams must choose either the Premier or Enterprise support packages with custom pricing.

Because of this, it can be difficult to estimate your costs if you have specific customer support needs, especially with CRM implementation. Many businesses opt to have outside experts handle implementation and development, another factor to consider in addition to advanced customer support costs.

Who Is Microsoft Dynamics 365 Best For?

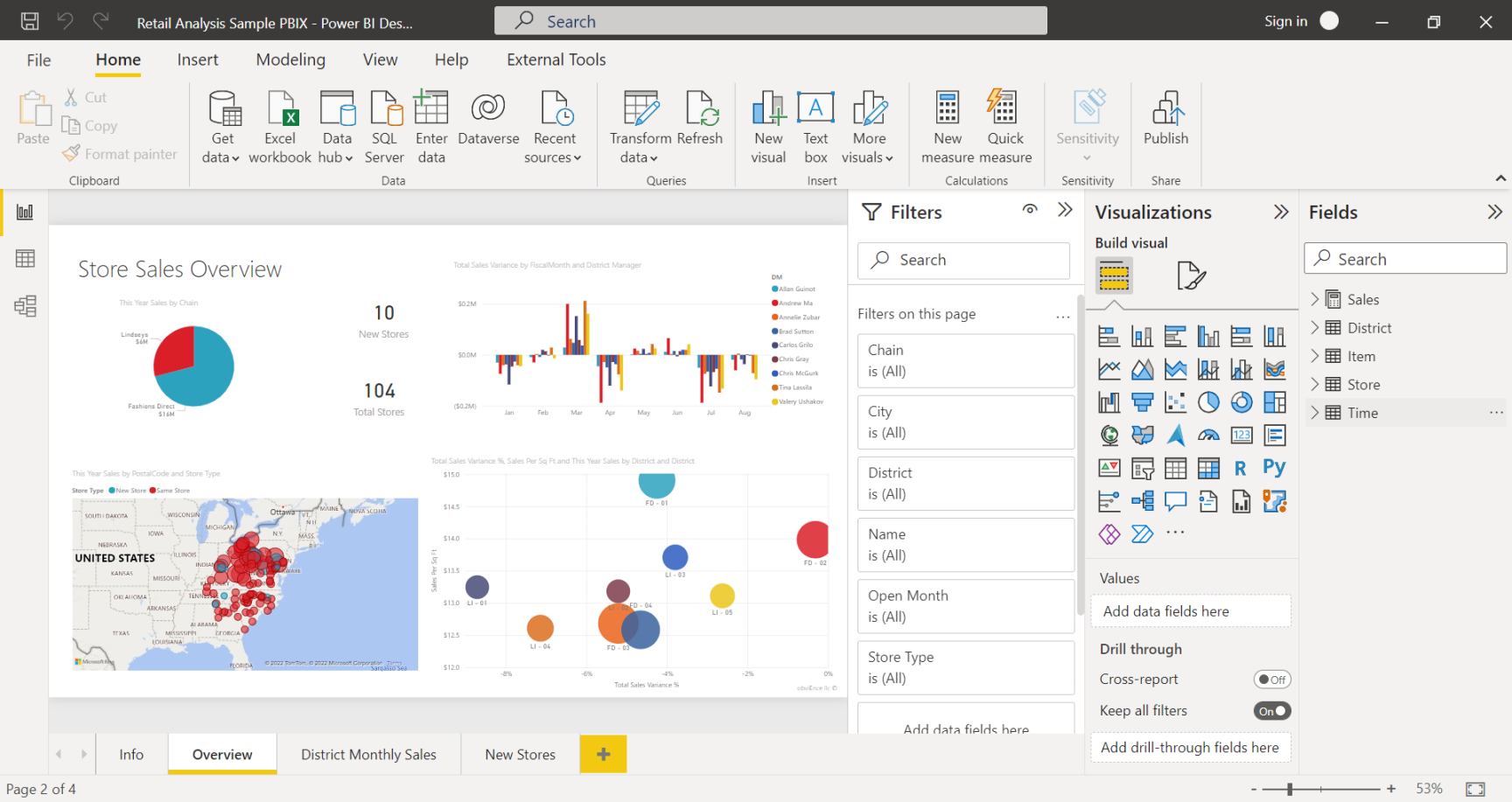

Microsoft Dynamics 365 makes sense for teams that want to use CRM data in the Microsoft products they already use daily. The Dynamics 365 platform integrates seamlessly with other Microsoft software such as Power BI (Business Insights), Outlook and Microsoft Teams. Businesses not already using Microsoft software may find it tricky to connect Microsoft Dynamics 365 to outside apps, which could create challenges with implementation and adoption.

Who Is Salesforce Best For?

Salesforce is best for teams that want complete control over their CRM and are willing to put in the effort for a more intensive implementation process. Salesforce can take time and effort to set up, and it comes with a learning curve, but for teams that can adopt it, it can be a powerhouse CRM tool.

How To Choose a CRM

When we surveyed CRM users, respondents said customization, unique features and customer service were among the most important things they considered when evaluating a potential CRM. We suggest creating a list of the non-negotiable features you know your team needs, which will help you narrow down your list of options. This also enables you to avoid expensive add-ons or higher-tier plans you may not need, keeping things simple and streamlined.

Source: MarketWatch Guides

We also recommend checking if the software has the native integration capabilities you’re looking for or if you’ll need some development support to make the software work with your daily workflow. It’s easy to check for integration capabilities on software providers’ app marketplaces. In this case, you’ll want to check Salesforce AppExchange and Microsoft AppSource.

Beyond this, it’s always a good idea to use free trials to test a product’s ease of use. If you don’t feel your team can handle the learning curve, it’s possible you won’t see as much adoption of the tool.

The Bottom Line

Salesforce and Microsoft Dynamics 365 are powerful CRM software options that can support CRM strategy for businesses of any size. Small businesses and startups should consider solutions like Dynamics 365 Business Central or Salesforce Stater Suite for pared-down feature lists and affordable pricing. Teams looking for a full-service CRM solution should compare Dynamics 365 Sales and the Salesforce Sales Cloud.

After testing these two products, we found that Salesforce stood apart for its integrations and extensive feature set availability. It would work well with other software you may already be using, and its customization options are endless. Microsoft Dynamics 365 makes the most sense if your team already uses other Microsoft software, such as Excel and Teams. It may be a challenge to connect it to outside software, and it’s missing basic marketing automation features for email and other channels.

Frequently Asked Questions Is Microsoft Dynamics or Salesforce better?

Salesforce is better for teams that want full control over their CRM system with many customization options. Microsoft Dynamics is better for current Microsoft users who want to power their work software ecosystem with a central place for organized CRM data.

As for marketing features, Dynamics 365 CRM is missing most marketing functionality. The Salesforce Sales Cloud includes the basics for email and social media marketing automation, and the Marketing Cloud can support even more advanced marketing tasks.

What is the main difference between Salesforce and Microsoft Dynamics?

The main difference between Salesforce and Microsoft Dynamics 365 is that Salesforce offers more customization, while Microsoft Dynamics leverages other Microsoft software like Excel and Office 365. Salesforce also provides more seamless integration capabilities with third-party apps.

Who is Salesforce’s biggest competitor?

Salesforce’s biggest competitors are HubSpot and Microsoft Dynamics 365, which are big-name comprehensive CRM solutions offering broad feature sets with relatively high pricing.

Who is Microsoft’s biggest competitor?

Microsoft’s biggest CRM competitors are Salesforce and HubSpot, which offer more customization options, user-friendly platforms and nativee marketing features.

Methodology

Customer relationship management (CRM) tools help businesses bring in new customers and nurture current ones. With different businesses come different business goals and CRM needs. So, the MarketWatch Guides team spent over 100 hours evaluating 13 providers to determine who each CRM is best for. We looked at big names, such as Salesforce and monday.com, as well as small providers, including Liondesk and Less Annoying CRM.

We conducted a survey in 2024 of 200 professionals who were currently using CRM or had used CRM within the past year. We analyzed the results of this survey to determine the following rating criteria:

User Experience (15%) Features (30%) Pricing (30%) Customer Support (15%) Reputation and Credibility (10%)

Visit the full CRM methodology page for more details on our rating system.

Microsoft’s cloud business powers 10% growth in quarterly profits

AP

REDMOND, Wash. (AP) — Microsoft reported a 10% increase in quarterly profits Tuesday as it tries to maintain its position as a leader in artificial intelligence technology.

The software giant said its fiscal fourth-quarter profit was $22 billion, or $2.95 per share, slightly beating analyst expectations for $2.94 per share.

It posted revenue of $64.7 billion in the April-June period, up 15% from last year. Analysts polled by FactSet Research had been looking for revenue of $64.4 billion.

Microsoft’s growth was led by its cloud computing business, where quarterly revenue rose 19% to $28.5 billion. That was still lower than what some analysts expected, leading to the stock shedding about 5% in after-hours trading Tuesday.

The Redmond, Washington-based company doesn’t report revenue specifically from AI products but says it has infused the technology into all of its business segments, particularly its Azure cloud computing contracts, but increasingly its workplace software and other products. Much of its generative AI technology has been built as part of its multibillion-dollar investments in OpenAI, maker of ChatGPT.

People are also reading…

Revenue from Microsoft’s productivity services – such as its Office line of products – rose 11% to $20.3 billion.

Microsoft’s personal computing business, centered on licensing its Windows operating system, made $15.9 billion for the quarter, up 14% from last year.

Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.

‘); var s = document.createElement(‘script’); s.setAttribute(‘src’, ‘https://assets.revcontent.com/master/delivery.js’); document.body.appendChild(s); window.removeEventListener(‘scroll’, throttledRevContent); __tnt.log(‘Load Rev Content’); } } }, 100); window.addEventListener(‘scroll’, throttledRevContent); }

Get local news delivered to your inbox!

Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Microsoft (NASDAQ:MSFT) will sharply capitalize on its partnership with Palantir Technologies (NYSE:PLTR). This collaboration will let the tech giant to boost Microsoft’s progressive cloud and AI services.

The partnership focuses on delivering advanced analytics and AI capabilities to the U.S. Defense and Intelligence Community. As a result, this collaboration will considerably boost Microsoft’s market valuation due to the synergetic integration of sharp tech and secure cloud environments.

Microsoft’s Azure cloud platform has seen high growth. The business generated revenue surpassing $135 billion, a 23% annual increase. Moreover, this growth is emerging from the increasing demand for secure and scalable cloud solutions, particularly in government and classified environments. Integrating Palantir’s suite of products, such as Foundry, Gotham, Apollo and AIP into Azure’s government cloud environments will further accelerate this growth.

This partnership enables Microsoft to offer a first-of-its-kind, integrated tech suite that meets the critical needs of national security missions. Further, expanding Azure’s capabilities through this partnership will likely derive long-term top-line growth, solidifying Microsoft stock’s strong buy rating.

Microsoft’s Edge On Advanced Cloud and Government Market Growth

The partnership with Palantir enhances Microsoft’s AI capabilities, particularly in secure and classified environments. Azure OpenAI Service, which provides access to large language models like GPT-4, will be deployed within Palantir’s AI Platforms in Microsoft’s government clouds. This integration allows operators to build AI-driven operational workloads safely and responsibly across various defense and intelligence verticals.

Additionally, leveraging AI for critical tasks such as logistics, contracting and action planning is a considerable value proposition. The growing importance of AI in government operations presents a substantial revenue opportunity for Microsoft, further supporting its high valuation.

Further, security and compliance are critical factors in cloud services, especially in government and classified environments. Microsoft’s Azure Government and Azure Government Secret clouds are among the most secure cloud environments available. The partnership with Palantir includes deploying Palantir’s products in these secure environments, enhancing Microsoft’s position as a trusted provider of secure cloud services.

However, the availability of these integrated solutions is subject to government authorization and accreditation, ensuring that the highest security standards are met. This focus on security and compliance is expected to increase the adoption of Microsoft’s cloud services, contributing to sustained top-line growth. Hence, these growth fundamentals make Microsoft stock a solid buy in the tech sector.

Increased Adoption of AI and Enhanced Data Integration

Microsoft has already made considerable investments in expanding its AI capabilities. These include the addition of AI accelerators from Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA) and its first-party silicon, Azure Maia. Introducing new AI models and services (such as Cobalt 100) provides best-in-class performance across various industries.

With over 60,000 Azure AI clients, up 60% annually, Microsoft will capitalize on the growing demand for AI-driven solutions. The partnership with Palantir will further boost the demand for Microsoft’s AI offerings, making them more attractive to government and enterprise clients. This expansion of AI capabilities is a key driver of Microsoft’s high valuation.

Overall, the partnership with Palantir will increase Microsoft’s adoption of AI and analytics tools, particularly in the government sector. Palantir’s Federal Cloud Service, which includes products like Gotham, Foundry, AIP and Apollo, is authorized to deploy on Microsoft Azure. This authorization opens up new opportunities for Microsoft to provide secure, AI-driven solutions to government agencies.

Fundamentally, the growing importance of AI and analytics in government operations presents a considerable revenue opportunity for the tech giant. Microsoft stock will hit higher market valuations as more government agencies adopt these tools. This value growth will align with the increasing revenue from AI and analytics.

Expanding Growth in Government and Defense Sectors

Moving forward, the partnership with Palantir positions Microsoft to seize a larger share of the booming government and defense sectors. These sectors increasingly shift to AI and advanced analytics to derive an operational edge and global lead.

In short, Microsoft’s Azure cloud platform and Palantir’s AI and data integration tools yield differentiated solutions for critical missions. The ability to provide secure, scalable and AI-driven solutions is a considerable edge in the government sector.

Finally, this growth in the government and defense sectors is expected to derive long-term revenue and value growth that supports the potential of high valuation for Microsoft stock.

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Yiannis Zourmpanos is the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth business analysis.

More From InvestorPlace

The post Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock appeared first on InvestorPlace.

Microsoft Dynamics vs. Salesforce: Comparison 2024 Salesforce vs. Microsoft Dynamics 365 Overview

Salesforce’s Sales Hub and Microsoft Dynamics 365 Sales are similar products that offer most of the CRM features you expect to find in standalone CRM software. We compare these two as the primary CRM offerings from both providers, though other products exist for marketing, customer service and other work management functions.

Salesforce is a highly customizable CRM that teams can configure for almost any business need, while Microsoft Dynamics 365 serves as a centralized place for customer data for teams that already use it.

Salesforce vs. Microsoft Dynamics 365 Comparison

In our survey, CRM users cited workflow automation, contact activity tracking and task management as the most important CRM features. We used these insights to guide us as we tested Salesforce and Microsoft Dynamics 365. There are some notable differences between the platforms’ contact and sales pipeline management approaches, but they offer similar sales assistants powered by artificial intelligence (AI). Microsoft Dynamics is also commonly known as an enterprise resource planning (ERP) tool.

Source: MarketWatch Guides

Features Overview

Salesforce and Microsoft Dynamics 365 offer very similar feature lists for CRM. However, Salesforce offers more native features for marketing automation. Microsoft Dynamics does not include any email-related features in the Sales product, which puts it at a disadvantage compared to many other CRM platforms. Our Salesforce Review and Microsoft Dynamics 365 Review offer more in-depth analyses of these platforms’ top features.

Salesforce Sales CloudMicrosoft Dynamics 365 SalesMonthly Price Range$20-$500/user$65-$135/userContact Management✅✅Workflow Automation✅✅Lead Management✅✅Lead Scoring✅✅Pipeline Management✅✅Sales Forecasting✅✅Email Marketing Automation✅❌Analytics✅✅AI-Powered Tools✅(Einstein)✅(Copilot AI)Phone Support✅✅Live Chat✅✅ Contact Management

Microsoft Dynamics 356’s contact profiles are well-organized and easy to navigate, following a similar structure to many popular CRM systems. When we tested the platform, the profiles stood out as one of the more user-friendly features. We could add notes and easily edit contact information without searching through settings.

Aside from the contact profiles, Microsoft Dynamics’s approach to the overall contact list is unique. The different Excel-powered charts allowed us to get quick insights into the customer data on the platform. For instance, we could create a drill-down chart of contacts by their city in just a few clicks. While testing the platform, we imagined plenty of use cases for these quick insights and charts.

By comparison, Salesforce keeps its analytics separate from the customer profiles, which is the typical setup for customer data within most CRM platforms. The Salesforce customer profiles display contact information alongside upcoming tasks logged in the platform, related opportunities, deals and any quotes a customer has received. These capabilities make it simple for sales teams to refer to any information they need about a customer.

View of a sample customer profile in Salesforce.

Sales Pipeline Management

Microsoft Dynamics’s approach to the sales pipeline is unique compared to other CRM systems we’ve tested. By default, the platform organizes deals in various charts highlighting the sales funnel stages. Most platforms include a list of open deals or, most often, a Kanban-style view of the different deal stages, with movable deal cards sorted into various boards indicating their status.

This could be a major plus for teams that don’t love a Kanban board. However, for teams looking for streamlined and straightforward opportunity management, it could overcomplicate how team members view the sales process in the platform.

Salesforce’s default configuration for the sales pipeline is a more traditional deal tracking board with the option for a list view. We liked that dragging and dropping the deal cards with automatic deal value calculations at the top of each stage in the pipeline was easy.

Sample view of the Salesforce sales pipeline.

AI-Powered Features

Both Microsoft and Salesforce include AI assistants in their CRM products. Microsoft’s Copilot AI and Salesforce’s Einstein AI are helpful chatbots that users can interact with, similar to ChatGPT. These AI-powered tools also power forecasting, predictive scoring and other advanced features.

Microsoft just rolled out Copilot AI last year, and it is helpful for tasks like generating a summary of an open deal; however, it struggled to understand natural language requests. AI tools across the CRM space are very new, and we expect they will learn and improve over time to help streamline CRM strategies.

Pricing

Microsoft Dynamics 365 and Salesforce offer similar CRM pricing structures, so comparing their pricing is straightforward. Microsoft’s primary sales product has a lower starting price than Salesforce’s Sales Cloud, and Salesforce has a much more comprehensive price range, with the top Einstein 1 Sales plan costing $500 per user per month.

However, both platforms offer “starter kits” at lower prices with various features across the board. In Salesforce’s case, these are the Starter Suite and Pro Suite, which include top features from the Sales, Marketing and Service Clouds. The Microsoft Dynamics Business Central product is similar, with key features from Dynamics 365 Sales and Service, emphasizing core business functions and finance rather than marketing.

Salesforce Pricing

Our Salesforce Pricing Guide offers a more in-depth look into Salesforce’s pricing structure.

ProductPlanPriceSalesforce Sales CloudProfessional $80/user/month Enterprise $165/user/monthUnlimited$330/user/month Einstein 1 Sales$500/user/month Small Business (Combines Sales, Marketing and Service features) Starter Suite$25/user/monthPro Suite$100/user/month Microsoft Dynamics Pricing ProductPlanPriceMicrosoft Dynamics 365 SalesProfessional $65/user/month Enterprise $95/user/monthPremium$135/user/month Microsoft Dynamics 365 Business CentralEssentials$70/monthPremium$100/month Integrations

Salesforce is difficult to beat when it comes to native integrations, and it’s easy to search for any specific third-party apps you need to connect with the Appexchange marketplace.

The Microsoft Dynamics 365 CRM is excellent as part of a Microsoft ecosystem, but connecting it with outside tools is more complicated.Competitor software like Google tools won’t be available, and we were also surprised to see that Zapier integration was not an option for Dynamics 365 in the Microsoft AppSource marketplace. However, both platforms offer an API for developers.

PlatformSalesforce Sales Cloud Microsoft Dynamics 365 SalesGmail✅❌Google Calendar✅❌Mailchimp✅✅Facebook Ads✅✅Zoom✅✅Slack✅✅Sprout Social✅✅Shopify✅✅Stripe✅✅PandaDoc✅✅DocuSign✅✅Five9✅✅Trello✅❌Asana✅❌Zapier✅❌ Customer Support

Salesforce and Microsoft Dynamics 365 include customer support via live chat and phone. Unlike Microsoft, Salesforce’s advanced support options typically require an upgraded support package. For instance, all Salesforce licenses include the Basic Support package, which consists of the phone and chat options you’d expect. However, for personalized onboarding support or a dedicated Customer Success Manager, teams must choose either the Premier or Enterprise support packages with custom pricing.

Because of this, it can be difficult to estimate your costs if you have specific customer support needs, especially with CRM implementation. Many businesses opt to have outside experts handle implementation and development, another factor to consider in addition to advanced customer support costs.

Who Is Microsoft Dynamics 365 Best For?

Microsoft Dynamics 365 makes sense for teams that want to use CRM data in the Microsoft products they already use daily. The Dynamics 365 platform integrates seamlessly with other Microsoft software such as Power BI (Business Insights), Outlook and Microsoft Teams. Businesses not already using Microsoft software may find it tricky to connect Microsoft Dynamics 365 to outside apps, which could create challenges with implementation and adoption.

Who Is Salesforce Best For?

Salesforce is best for teams that want complete control over their CRM and are willing to put in the effort for a more intensive implementation process. Salesforce can take time and effort to set up, and it comes with a learning curve, but for teams that can adopt it, it can be a powerhouse CRM tool.

How To Choose a CRM

When we surveyed CRM users, respondents said customization, unique features and customer service were among the most important things they considered when evaluating a potential CRM. We suggest creating a list of the non-negotiable features you know your team needs, which will help you narrow down your list of options. This also enables you to avoid expensive add-ons or higher-tier plans you may not need, keeping things simple and streamlined.

Source: MarketWatch Guides

We also recommend checking if the software has the native integration capabilities you’re looking for or if you’ll need some development support to make the software work with your daily workflow. It’s easy to check for integration capabilities on software providers’ app marketplaces. In this case, you’ll want to check Salesforce AppExchange and Microsoft AppSource.

Beyond this, it’s always a good idea to use free trials to test a product’s ease of use. If you don’t feel your team can handle the learning curve, it’s possible you won’t see as much adoption of the tool.

The Bottom Line

Salesforce and Microsoft Dynamics 365 are powerful CRM software options that can support CRM strategy for businesses of any size. Small businesses and startups should consider solutions like Dynamics 365 Business Central or Salesforce Stater Suite for pared-down feature lists and affordable pricing. Teams looking for a full-service CRM solution should compare Dynamics 365 Sales and the Salesforce Sales Cloud.

After testing these two products, we found that Salesforce stood apart for its integrations and extensive feature set availability. It would work well with other software you may already be using, and its customization options are endless. Microsoft Dynamics 365 makes the most sense if your team already uses other Microsoft software, such as Excel and Teams. It may be a challenge to connect it to outside software, and it’s missing basic marketing automation features for email and other channels.

Frequently Asked Questions Is Microsoft Dynamics or Salesforce better?

Salesforce is better for teams that want full control over their CRM system with many customization options. Microsoft Dynamics is better for current Microsoft users who want to power their work software ecosystem with a central place for organized CRM data.

As for marketing features, Dynamics 365 CRM is missing most marketing functionality. The Salesforce Sales Cloud includes the basics for email and social media marketing automation, and the Marketing Cloud can support even more advanced marketing tasks.

What is the main difference between Salesforce and Microsoft Dynamics?

The main difference between Salesforce and Microsoft Dynamics 365 is that Salesforce offers more customization, while Microsoft Dynamics leverages other Microsoft software like Excel and Office 365. Salesforce also provides more seamless integration capabilities with third-party apps.

Who is Salesforce’s biggest competitor?

Salesforce’s biggest competitors are HubSpot and Microsoft Dynamics 365, which are big-name comprehensive CRM solutions offering broad feature sets with relatively high pricing.

Who is Microsoft’s biggest competitor?

Microsoft’s biggest CRM competitors are Salesforce and HubSpot, which offer more customization options, user-friendly platforms and nativee marketing features.

Methodology

Customer relationship management (CRM) tools help businesses bring in new customers and nurture current ones. With different businesses come different business goals and CRM needs. So, the MarketWatch Guides team spent over 100 hours evaluating 13 providers to determine who each CRM is best for. We looked at big names, such as Salesforce and monday.com, as well as small providers, including Liondesk and Less Annoying CRM.

We conducted a survey in 2024 of 200 professionals who were currently using CRM or had used CRM within the past year. We analyzed the results of this survey to determine the following rating criteria:

User Experience (15%) Features (30%) Pricing (30%) Customer Support (15%) Reputation and Credibility (10%)

Visit the full CRM methodology page for more details on our rating system.

Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Microsoft (NASDAQ:MSFT) will sharply capitalize on its partnership with Palantir Technologies (NYSE:PLTR). This collaboration will let the tech giant to boost Microsoft’s progressive cloud and AI services.

The partnership focuses on delivering advanced analytics and AI capabilities to the U.S. Defense and Intelligence Community. As a result, this collaboration will considerably boost Microsoft’s market valuation due to the synergetic integration of sharp tech and secure cloud environments.

Microsoft’s Azure cloud platform has seen high growth. The business generated revenue surpassing $135 billion, a 23% annual increase. Moreover, this growth is emerging from the increasing demand for secure and scalable cloud solutions, particularly in government and classified environments. Integrating Palantir’s suite of products, such as Foundry, Gotham, Apollo and AIP into Azure’s government cloud environments will further accelerate this growth.

This partnership enables Microsoft to offer a first-of-its-kind, integrated tech suite that meets the critical needs of national security missions. Further, expanding Azure’s capabilities through this partnership will likely derive long-term top-line growth, solidifying Microsoft stock’s strong buy rating.

Microsoft’s Edge On Advanced Cloud and Government Market Growth

The partnership with Palantir enhances Microsoft’s AI capabilities, particularly in secure and classified environments. Azure OpenAI Service, which provides access to large language models like GPT-4, will be deployed within Palantir’s AI Platforms in Microsoft’s government clouds. This integration allows operators to build AI-driven operational workloads safely and responsibly across various defense and intelligence verticals.

Additionally, leveraging AI for critical tasks such as logistics, contracting and action planning is a considerable value proposition. The growing importance of AI in government operations presents a substantial revenue opportunity for Microsoft, further supporting its high valuation.

Further, security and compliance are critical factors in cloud services, especially in government and classified environments. Microsoft’s Azure Government and Azure Government Secret clouds are among the most secure cloud environments available. The partnership with Palantir includes deploying Palantir’s products in these secure environments, enhancing Microsoft’s position as a trusted provider of secure cloud services.

However, the availability of these integrated solutions is subject to government authorization and accreditation, ensuring that the highest security standards are met. This focus on security and compliance is expected to increase the adoption of Microsoft’s cloud services, contributing to sustained top-line growth. Hence, these growth fundamentals make Microsoft stock a solid buy in the tech sector.

Increased Adoption of AI and Enhanced Data Integration

Microsoft has already made considerable investments in expanding its AI capabilities. These include the addition of AI accelerators from Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA) and its first-party silicon, Azure Maia. Introducing new AI models and services (such as Cobalt 100) provides best-in-class performance across various industries.

With over 60,000 Azure AI clients, up 60% annually, Microsoft will capitalize on the growing demand for AI-driven solutions. The partnership with Palantir will further boost the demand for Microsoft’s AI offerings, making them more attractive to government and enterprise clients. This expansion of AI capabilities is a key driver of Microsoft’s high valuation.

Overall, the partnership with Palantir will increase Microsoft’s adoption of AI and analytics tools, particularly in the government sector. Palantir’s Federal Cloud Service, which includes products like Gotham, Foundry, AIP and Apollo, is authorized to deploy on Microsoft Azure. This authorization opens up new opportunities for Microsoft to provide secure, AI-driven solutions to government agencies.

Fundamentally, the growing importance of AI and analytics in government operations presents a considerable revenue opportunity for the tech giant. Microsoft stock will hit higher market valuations as more government agencies adopt these tools. This value growth will align with the increasing revenue from AI and analytics.

Expanding Growth in Government and Defense Sectors

Moving forward, the partnership with Palantir positions Microsoft to seize a larger share of the booming government and defense sectors. These sectors increasingly shift to AI and advanced analytics to derive an operational edge and global lead.

In short, Microsoft’s Azure cloud platform and Palantir’s AI and data integration tools yield differentiated solutions for critical missions. The ability to provide secure, scalable and AI-driven solutions is a considerable edge in the government sector.

Finally, this growth in the government and defense sectors is expected to derive long-term revenue and value growth that supports the potential of high valuation for Microsoft stock.

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Yiannis Zourmpanos is the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth business analysis.

More From InvestorPlace

The post Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock appeared first on InvestorPlace.

Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Microsoft (NASDAQ:MSFT) will sharply capitalize on its partnership with Palantir Technologies (NYSE:PLTR). This collaboration will let the tech giant to boost Microsoft’s progressive cloud and AI services.

The partnership focuses on delivering advanced analytics and AI capabilities to the U.S. Defense and Intelligence Community. As a result, this collaboration will considerably boost Microsoft’s market valuation due to the synergetic integration of sharp tech and secure cloud environments.

Microsoft’s Azure cloud platform has seen high growth. The business generated revenue surpassing $135 billion, a 23% annual increase. Moreover, this growth is emerging from the increasing demand for secure and scalable cloud solutions, particularly in government and classified environments. Integrating Palantir’s suite of products, such as Foundry, Gotham, Apollo and AIP into Azure’s government cloud environments will further accelerate this growth.

This partnership enables Microsoft to offer a first-of-its-kind, integrated tech suite that meets the critical needs of national security missions. Further, expanding Azure’s capabilities through this partnership will likely derive long-term top-line growth, solidifying Microsoft stock’s strong buy rating.

Microsoft’s Edge On Advanced Cloud and Government Market Growth

The partnership with Palantir enhances Microsoft’s AI capabilities, particularly in secure and classified environments. Azure OpenAI Service, which provides access to large language models like GPT-4, will be deployed within Palantir’s AI Platforms in Microsoft’s government clouds. This integration allows operators to build AI-driven operational workloads safely and responsibly across various defense and intelligence verticals.

Additionally, leveraging AI for critical tasks such as logistics, contracting and action planning is a considerable value proposition. The growing importance of AI in government operations presents a substantial revenue opportunity for Microsoft, further supporting its high valuation.

Further, security and compliance are critical factors in cloud services, especially in government and classified environments. Microsoft’s Azure Government and Azure Government Secret clouds are among the most secure cloud environments available. The partnership with Palantir includes deploying Palantir’s products in these secure environments, enhancing Microsoft’s position as a trusted provider of secure cloud services.

However, the availability of these integrated solutions is subject to government authorization and accreditation, ensuring that the highest security standards are met. This focus on security and compliance is expected to increase the adoption of Microsoft’s cloud services, contributing to sustained top-line growth. Hence, these growth fundamentals make Microsoft stock a solid buy in the tech sector.

Increased Adoption of AI and Enhanced Data Integration

Microsoft has already made considerable investments in expanding its AI capabilities. These include the addition of AI accelerators from Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA) and its first-party silicon, Azure Maia. Introducing new AI models and services (such as Cobalt 100) provides best-in-class performance across various industries.

With over 60,000 Azure AI clients, up 60% annually, Microsoft will capitalize on the growing demand for AI-driven solutions. The partnership with Palantir will further boost the demand for Microsoft’s AI offerings, making them more attractive to government and enterprise clients. This expansion of AI capabilities is a key driver of Microsoft’s high valuation.

Overall, the partnership with Palantir will increase Microsoft’s adoption of AI and analytics tools, particularly in the government sector. Palantir’s Federal Cloud Service, which includes products like Gotham, Foundry, AIP and Apollo, is authorized to deploy on Microsoft Azure. This authorization opens up new opportunities for Microsoft to provide secure, AI-driven solutions to government agencies.

Fundamentally, the growing importance of AI and analytics in government operations presents a considerable revenue opportunity for the tech giant. Microsoft stock will hit higher market valuations as more government agencies adopt these tools. This value growth will align with the increasing revenue from AI and analytics.

Expanding Growth in Government and Defense Sectors

Moving forward, the partnership with Palantir positions Microsoft to seize a larger share of the booming government and defense sectors. These sectors increasingly shift to AI and advanced analytics to derive an operational edge and global lead.

In short, Microsoft’s Azure cloud platform and Palantir’s AI and data integration tools yield differentiated solutions for critical missions. The ability to provide secure, scalable and AI-driven solutions is a considerable edge in the government sector.

Finally, this growth in the government and defense sectors is expected to derive long-term revenue and value growth that supports the potential of high valuation for Microsoft stock.

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Yiannis Zourmpanos is the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth business analysis.

More From InvestorPlace

The post Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock appeared first on InvestorPlace.

Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Microsoft (NASDAQ:MSFT) will sharply capitalize on its partnership with Palantir Technologies (NYSE:PLTR). This collaboration will let the tech giant to boost Microsoft’s progressive cloud and AI services.

The partnership focuses on delivering advanced analytics and AI capabilities to the U.S. Defense and Intelligence Community. As a result, this collaboration will considerably boost Microsoft’s market valuation due to the synergetic integration of sharp tech and secure cloud environments.

Microsoft’s Azure cloud platform has seen high growth. The business generated revenue surpassing $135 billion, a 23% annual increase. Moreover, this growth is emerging from the increasing demand for secure and scalable cloud solutions, particularly in government and classified environments. Integrating Palantir’s suite of products, such as Foundry, Gotham, Apollo and AIP into Azure’s government cloud environments will further accelerate this growth.

This partnership enables Microsoft to offer a first-of-its-kind, integrated tech suite that meets the critical needs of national security missions. Further, expanding Azure’s capabilities through this partnership will likely derive long-term top-line growth, solidifying Microsoft stock’s strong buy rating.

Microsoft’s Edge On Advanced Cloud and Government Market Growth

The partnership with Palantir enhances Microsoft’s AI capabilities, particularly in secure and classified environments. Azure OpenAI Service, which provides access to large language models like GPT-4, will be deployed within Palantir’s AI Platforms in Microsoft’s government clouds. This integration allows operators to build AI-driven operational workloads safely and responsibly across various defense and intelligence verticals.

Additionally, leveraging AI for critical tasks such as logistics, contracting and action planning is a considerable value proposition. The growing importance of AI in government operations presents a substantial revenue opportunity for Microsoft, further supporting its high valuation.

Further, security and compliance are critical factors in cloud services, especially in government and classified environments. Microsoft’s Azure Government and Azure Government Secret clouds are among the most secure cloud environments available. The partnership with Palantir includes deploying Palantir’s products in these secure environments, enhancing Microsoft’s position as a trusted provider of secure cloud services.

However, the availability of these integrated solutions is subject to government authorization and accreditation, ensuring that the highest security standards are met. This focus on security and compliance is expected to increase the adoption of Microsoft’s cloud services, contributing to sustained top-line growth. Hence, these growth fundamentals make Microsoft stock a solid buy in the tech sector.

Increased Adoption of AI and Enhanced Data Integration

Microsoft has already made considerable investments in expanding its AI capabilities. These include the addition of AI accelerators from Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA) and its first-party silicon, Azure Maia. Introducing new AI models and services (such as Cobalt 100) provides best-in-class performance across various industries.

With over 60,000 Azure AI clients, up 60% annually, Microsoft will capitalize on the growing demand for AI-driven solutions. The partnership with Palantir will further boost the demand for Microsoft’s AI offerings, making them more attractive to government and enterprise clients. This expansion of AI capabilities is a key driver of Microsoft’s high valuation.

Overall, the partnership with Palantir will increase Microsoft’s adoption of AI and analytics tools, particularly in the government sector. Palantir’s Federal Cloud Service, which includes products like Gotham, Foundry, AIP and Apollo, is authorized to deploy on Microsoft Azure. This authorization opens up new opportunities for Microsoft to provide secure, AI-driven solutions to government agencies.

Fundamentally, the growing importance of AI and analytics in government operations presents a considerable revenue opportunity for the tech giant. Microsoft stock will hit higher market valuations as more government agencies adopt these tools. This value growth will align with the increasing revenue from AI and analytics.

Expanding Growth in Government and Defense Sectors

Moving forward, the partnership with Palantir positions Microsoft to seize a larger share of the booming government and defense sectors. These sectors increasingly shift to AI and advanced analytics to derive an operational edge and global lead.

In short, Microsoft’s Azure cloud platform and Palantir’s AI and data integration tools yield differentiated solutions for critical missions. The ability to provide secure, scalable and AI-driven solutions is a considerable edge in the government sector.

Finally, this growth in the government and defense sectors is expected to derive long-term revenue and value growth that supports the potential of high valuation for Microsoft stock.

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Yiannis Zourmpanos is the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth business analysis.

More From InvestorPlace

The post Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock appeared first on InvestorPlace.

Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Microsoft (NASDAQ:MSFT) will sharply capitalize on its partnership with Palantir Technologies (NYSE:PLTR). This collaboration will let the tech giant to boost Microsoft’s progressive cloud and AI services.

The partnership focuses on delivering advanced analytics and AI capabilities to the U.S. Defense and Intelligence Community. As a result, this collaboration will considerably boost Microsoft’s market valuation due to the synergetic integration of sharp tech and secure cloud environments.

Microsoft’s Azure cloud platform has seen high growth. The business generated revenue surpassing $135 billion, a 23% annual increase. Moreover, this growth is emerging from the increasing demand for secure and scalable cloud solutions, particularly in government and classified environments. Integrating Palantir’s suite of products, such as Foundry, Gotham, Apollo and AIP into Azure’s government cloud environments will further accelerate this growth.

This partnership enables Microsoft to offer a first-of-its-kind, integrated tech suite that meets the critical needs of national security missions. Further, expanding Azure’s capabilities through this partnership will likely derive long-term top-line growth, solidifying Microsoft stock’s strong buy rating.

Microsoft’s Edge On Advanced Cloud and Government Market Growth

The partnership with Palantir enhances Microsoft’s AI capabilities, particularly in secure and classified environments. Azure OpenAI Service, which provides access to large language models like GPT-4, will be deployed within Palantir’s AI Platforms in Microsoft’s government clouds. This integration allows operators to build AI-driven operational workloads safely and responsibly across various defense and intelligence verticals.

Additionally, leveraging AI for critical tasks such as logistics, contracting and action planning is a considerable value proposition. The growing importance of AI in government operations presents a substantial revenue opportunity for Microsoft, further supporting its high valuation.

Further, security and compliance are critical factors in cloud services, especially in government and classified environments. Microsoft’s Azure Government and Azure Government Secret clouds are among the most secure cloud environments available. The partnership with Palantir includes deploying Palantir’s products in these secure environments, enhancing Microsoft’s position as a trusted provider of secure cloud services.

However, the availability of these integrated solutions is subject to government authorization and accreditation, ensuring that the highest security standards are met. This focus on security and compliance is expected to increase the adoption of Microsoft’s cloud services, contributing to sustained top-line growth. Hence, these growth fundamentals make Microsoft stock a solid buy in the tech sector.

Increased Adoption of AI and Enhanced Data Integration

Microsoft has already made considerable investments in expanding its AI capabilities. These include the addition of AI accelerators from Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA) and its first-party silicon, Azure Maia. Introducing new AI models and services (such as Cobalt 100) provides best-in-class performance across various industries.

With over 60,000 Azure AI clients, up 60% annually, Microsoft will capitalize on the growing demand for AI-driven solutions. The partnership with Palantir will further boost the demand for Microsoft’s AI offerings, making them more attractive to government and enterprise clients. This expansion of AI capabilities is a key driver of Microsoft’s high valuation.

Overall, the partnership with Palantir will increase Microsoft’s adoption of AI and analytics tools, particularly in the government sector. Palantir’s Federal Cloud Service, which includes products like Gotham, Foundry, AIP and Apollo, is authorized to deploy on Microsoft Azure. This authorization opens up new opportunities for Microsoft to provide secure, AI-driven solutions to government agencies.

Fundamentally, the growing importance of AI and analytics in government operations presents a considerable revenue opportunity for the tech giant. Microsoft stock will hit higher market valuations as more government agencies adopt these tools. This value growth will align with the increasing revenue from AI and analytics.

Expanding Growth in Government and Defense Sectors

Moving forward, the partnership with Palantir positions Microsoft to seize a larger share of the booming government and defense sectors. These sectors increasingly shift to AI and advanced analytics to derive an operational edge and global lead.

In short, Microsoft’s Azure cloud platform and Palantir’s AI and data integration tools yield differentiated solutions for critical missions. The ability to provide secure, scalable and AI-driven solutions is a considerable edge in the government sector.

Finally, this growth in the government and defense sectors is expected to derive long-term revenue and value growth that supports the potential of high valuation for Microsoft stock.

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Yiannis Zourmpanos is the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth business analysis.

More From InvestorPlace

The post Microsoft’s Secret Weapon: This AI Power Move Is Promising for MSFT Stock appeared first on InvestorPlace.